Total and permanent disability (TPD) insurance

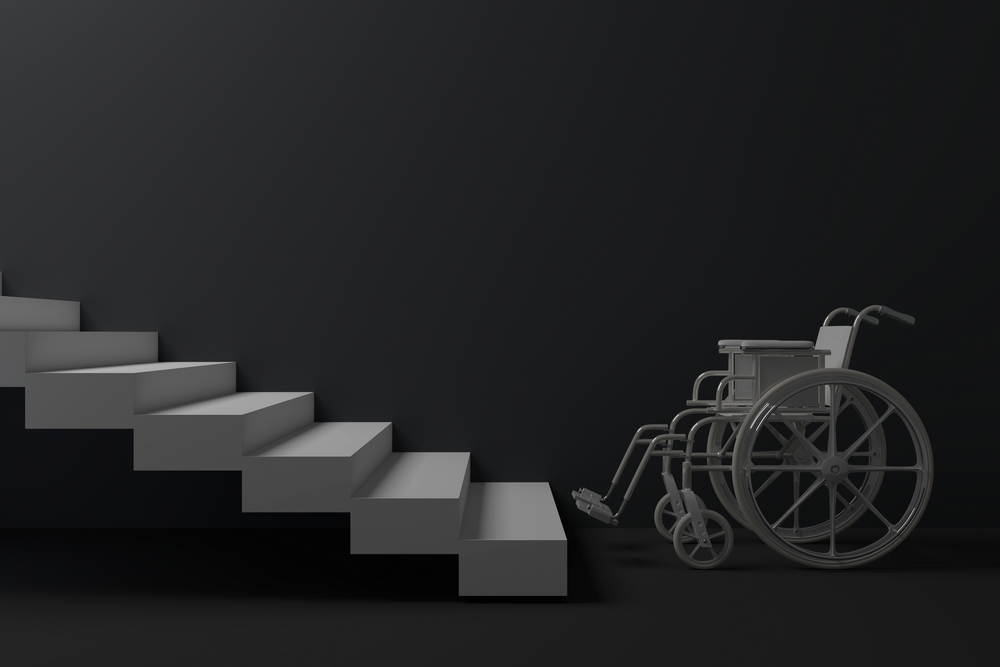

A permanent injury or illness can make it difficult or impossible to return work. TPD insurance can provide a financial safety net to help support you and your family, and pay for medical and rehabilitation costs.

What TPD insurance covers

TPD insurance pays a lump sum if you become totally and permanently disabled because of illness or injury.

Each insurer has a different definition of what it means to be totally and permanently disabled. It can cover you for either:

- Your own occupation — you’re unable to work again in the job you were working in before your disability. This cover is more expensive and is usually only available outside super.

- Any occupation — you’re unable to ever work again in any job suited to your education, training or experience. This cover is cheaper but has a higher threshold to claim, so it’s less likely to payout.

Read the product disclosure statement (PDS) so you know how your insurer defines a total and permanent disability. Call the insurer or your super fund if you have questions about the policy.

Decide if you need TPD insurance

When deciding if you need TPD insurance, and how much, think about the expenses you’ll need to cover if you were permanently disabled and unable to work. These could include:

- living expenses for you and your family

- repaying debts such as a mortgage or credit card

- medical and rehabilitation costs

- savings you want for retirement

Also, think about what you have that could help pay for these costs. This could include:

- private health insurance that can help pay for medical expenses

- if you have trauma or income protection insurance, that can help replace lost income. You may hold these insurances through your super fund

- any savings or investment you could sell

- what support from family or friends may be available

The gap between the amount you have and the amount you’ll need can be a guide as to how much TPD cover you may need.

If you need help deciding if you need TPD insurance, and how much, speak to a financial adviser.

How to buy TPD insurance

Check if you already hold TPD insurance through your super. Most super funds offer default TPD cover that’s cheaper than buying it directly. You can increase your level of cover through your super fund if you need to.

You can also buy TPD insurance from:

- a financial adviser

- insurance broker

- an insurance company

TPD insurance can be bought on its own or packaged with life cover. If it’s packaged, your life cover may be reduced by any amount paid out on a TPD claim. Check the PDS or ask your insurer.

Before buying, renewing or switching insurance, check if the policy will cover you for claims associated with COVID-19.

TPD insurance premiums

You can generally choose to pay for TPD insurance with either:

- stepped premiums — recalculated at each policy renewal, usually increasing each year based on the higher chance of a claim as you age

- level premiums — charge a higher premium at the start of the policy, but changes to cost aren’t based on your age so increases happen more slowly over time

Your choice of stepped or level premiums has a large impact on how much your premiums will cost now and in the future.

Compare TPD insurance policies

Before you buy TPD insurance, compare policies to make sure you get the right one for you. Check:

- if it covers ‘your own occupation’ or ‘any occupation’

- exclusions

- waiting periods before you can claim

- limits on cover

- premiums – now and in the future.

A cheaper policy may have more exclusions, or it may become more expensive in the future.

Use our Life insurance claims comparison tool

Compare how long different insurers take to pay a TPD claim and the percentage of claims they pay out.

What you need to tell your insurer

You need to tell your insurer anything that could affect their decision to provide you with TPD insurance. You need to give them this information when you apply, renew or change your level of cover.

Insurers usually ask for information about your:

- age

- job

- medical history

- family history, such as a history of disease

- lifestyle (for example, if you’re a smoker)

- high-risk sports or hobbies (such as skydiving)

If an insurer doesn’t ask for your medical history, it may mean their policy has more exclusions or narrower policy definitions.

The information you provide will help the insurer to decide:

- if they should insure you

- how much your premiums will be

- terms and conditions for your policy

It is important that you answer the questions honestly. Providing misleading answers could lead an insurer to decline a claim you make.

Please reach out to the Sherlock Wealth team to discuss what insurance cover you may need here.

MoneySmart

(ASIC)