Monthly Market Review – October 2021

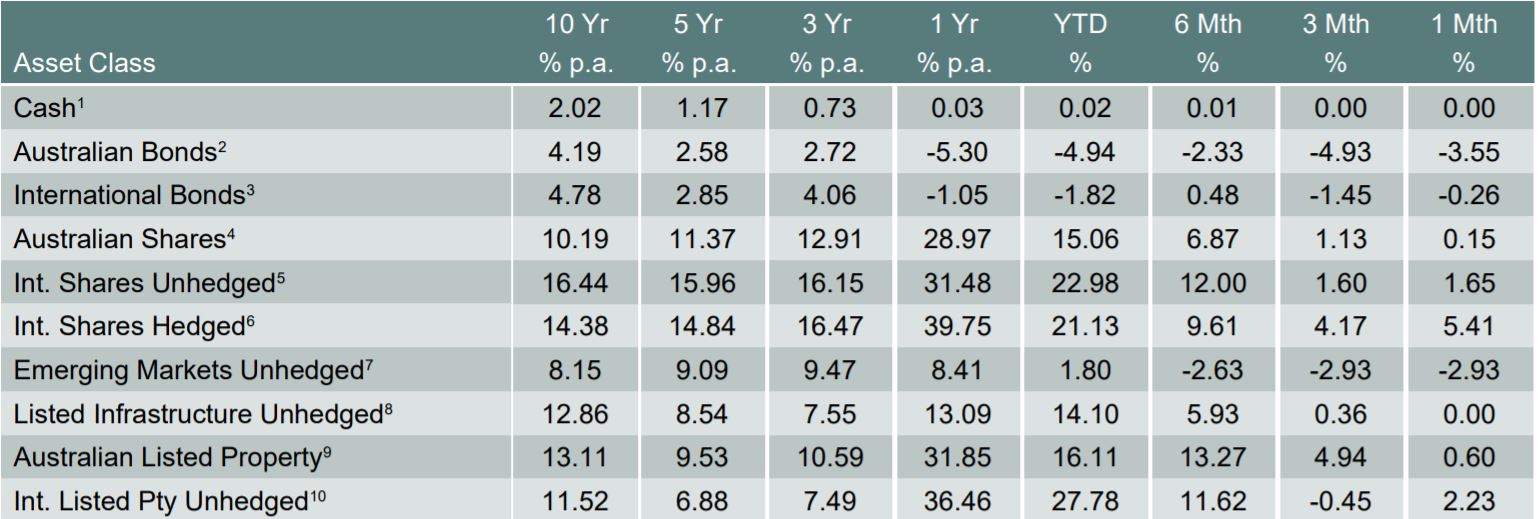

VIEW PDFHow the different asset classes have fared (As at 31 October 2021)

1 Bloomberg AusBond Bank 0+Y TR AUD, 2 Bloomberg AusBond Composite 0+Y TR AUD, 3 Bloomberg Barclays Global Aggregate TR Hdg AUD, 4 S&P/ASX All Ordinaries TR, 5 Vanguard International Shares Index, 6 Vanguard Intl Shares Index Hdg AUD TR, 7 Vanguard Emerging Markets Shares Index, 8 FTSE Developed Core Infrastructure 50/50 NR AUD, 9 S&P/ASX 300 AREIT TR, 10 FTSE EPRA/NAREIT Global REITs NR AUD

Source: Centrepoint Research Team, Morningstar Direct

International Equities

International share markets (unhedged) rose 1.65% in October. Fully hedged international shares rose 5.41% on the month signaling a strengthening AUD across the month. Within the United States, the S&P 500 continues to make new all-time highs as markets in general have largely shrugged off the fears of inflation.

Australian Equities

The S&P/ASX All Ordinaries Index rose by 0.15% in October, not nearly as much as other markets such as the US. Australian equities have traded largely sidewards since August. The primary driver has been the impact of the sharp fall in the iron ore spot price on major materials companies. These companies make up a significant percentage of the wider index. This is combined with various economic indicators such a rise in unemployment and a fall in consumer confidence which can be attributed to a slight rise in inflation expectations.

Domestic and International Fixed Income

Australian bonds had a significant fall in the final week of October (-3.55%). This was driven by an indication of policy change by the RBA as they stopped purchasing short-dated bonds which was part of their yield-curve control policy. Short-term yields rose sharply causing the Australian Bond Index to sell off. Sooner than expected rate rises could be what the RBA is attempting to set the stage for.

International bonds fell -0.26% as long dated government yields rose slightly. Inflation is now sitting at a 30 year high in the United States and looks to be moving upwards in many countries around the world. This is having an impact on bond yields and may cause central banks to start thinking about rising rates at a faster pace than previously anticipated.

Australian Dollar

The Australian dollar rose significantly in the month of October as it continues to move in a choppy trading pattern. Multiple factors such as rising inflation, central bank policy expectations, economic impacts of a slowing China and internal economic dynamics are all trying to be priced into the Australian Dollar causing a lack of clear trading direction at this point in time.

General Advice Warning

Sherlock Wealth Pty Ltd is a Corporate Authorised Representative of Matrix Planning Solutions Pty Ltd AFSL & ACL No. 238256, ABN 45 087 470 200. This information is of a general nature only and has been prepared without taking into account your particular financial needs, circumstances and objectives. No representation or warranty is made as to the accuracy, completeness or reliability of any estimates, opinions, conclusions or other information contained in this document. This document may contain certain forward-looking statements. Forward- looking statements are not guarantees of future performance and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control. You should not place reliance on forward-looking statements. To the maximum extent permitted by law, we and Matrix Planning Solutions Limited disclaims all liability and responsibility for any direct or indirect loss or damage which may be suffered as a result of relying on anything in this document including any forward-looking statements. Past performance is not an indication of future performance.

The attached material prepared by Ventura Investment Management Limited (AFSL 253045), Matrix Planning Solutions Limited and its related bodies corporate do not endorse or make any representations as to the accuracy or suitability of the information contained in the Materials including but not limited to any links to websites and does not accept any responsibility or liability for the content of the Material. This information is not advice. Before acting on any information, you should first seek financial advice from your financial adviser and where appropriate review and consider the relevant Product Disclosure Statement