Month in Review as at July 2023

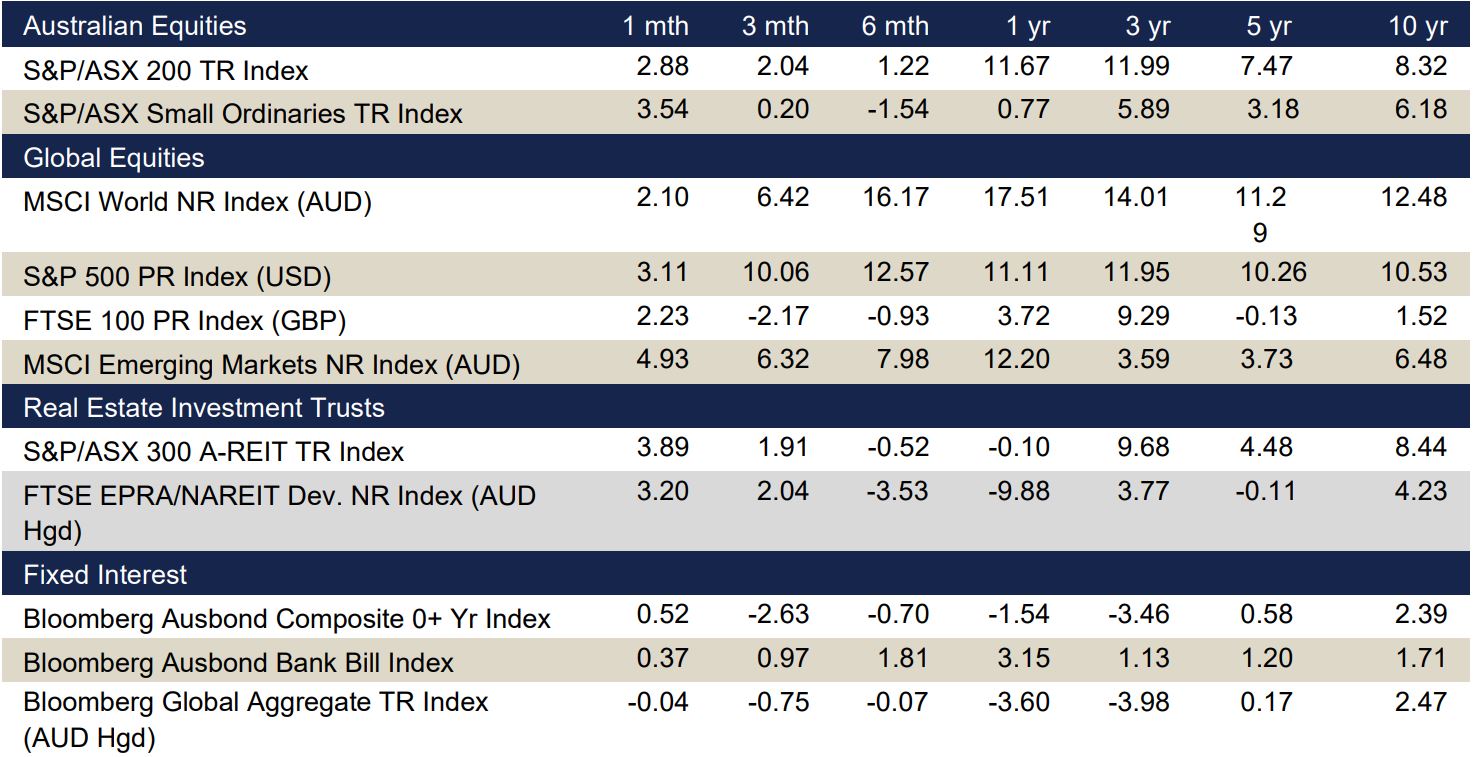

VIEW PDFIndex returns at end July 2023 (%)

Data source: Bloomberg & Financial Express. Returns greater than one year are annualised.

Commentary regarding equity indices below references performance without including the effects of currency (unless specifically stated).

Key Points

- The Australian equity market finished up 2.9% in July. Most sectors delivered strong returns led by energy (+8.8%), Financials ex-Property (4.9%) and Information Technology (4.5%), while Health Care (-1.5%) and Consumer Staples (- 1.0%) were the only laggards.

- Except for Japan, most global markets finished stronger in July. The S&P 500 (USD) returned 3.2%, while the Nikkei 225 Index (JPY) was flat. European markets were softer over the month, with the FTSE 100 Index (GBP) (2.4%), and FTSE Europtop 100 Index (EUR) (1.5%). Chinese markets, as represented by the CSI 300 Index (CNY) finished the month 5.4% higher.

Australian equities

The S&P/ASX 200 Accumulation Index finished July up 2.9%, the second-best monthly performance for the index this year. Commodity price rises aided the gains, while consumer sentiment has improved with positive inflation and employment data releases. Energy (+8.8%), Financials ex-Property (+4.9%), Information Technology (I.T.) (+4.5%) and Utilities (+4.0%) led Sectors. In all, 9 of the 11 Sectors in the Index finished positively, with Health Care (-1.5%) and Consumer Staples (-1.0%) the only laggards.

The driving factor in Energy names was rising commodity prices, particularly oil. This was evident in the gains Woodside (ASX: WDS), whose stock also benefitted from a quarterly update that was received positively by investors. Meanwhile, the other monthly leader, Financials ex-Property, saw investors pile into the “Big 4” banks, which all had strong months in July. While the RBA has left rates on hold, the banks have continued to increase their rates for home loan borrowers. Investors expect the rate rises from the lenders to ease competition and lead to higher net interest margins.

The month saw all Factors perform positively, led by Enhanced Value (+6.3%), Shareholder Yield (+5.5%) and Quality (+4.1%).

Global equities

Global equities ended in a predominantly positive month with stabilising economic data. Emerging markets outperformed developed market counterparts returning 4.9% (MSCI Emerging Markets Index (AUD)) versus a 2.1% gain according to the MSCI World Ex Australia Index (AUD).

The U.S. markets had mixed results again, with inflation data falling in line with another expected rate hike. Most sectors were positive with standouts in Technology and Energy rising largely due to increased strength in suppliers. The S&P500 Index posted a gain of 3.2% (in local currency terms).

Emerging markets rallied strongest for the month, as China’s economic growth recovery plan continues, with new stimulus having positive effects across sectors; specifically manufacturing and real estate as indicated by development data. The CSI 300 Index returned 5.3% for the month (in local currency terms).

Property

The S&P/ASX 200 A-REIT Accumulation index advanced during July, with the index finishing the month 3.8% higher. Global real estate equities (represented by the FTSE EPRA/NAREIT Developed Ex Australia Index (AUD Hedged)) also finished strongly, advancing 3.2% for the month. Australian infrastructure performed well during July, with the S&P/ASX Infrastructure Index TR advancing 4.1% for the month and up 13.2% YTD.

July was relatively quiet across the A-REITs sector. Some activities include Abacus Property Group (ASX: ABP) successfully completing the retail offer of their Abacus Storage King (ASX: ASK) REIT. This offer raised gross proceeds of approximately $34m which follows the institutional component last month that raised $191m. Charter Hall Retail REIT (ASX: CQR) announced the sale of their Bricksworth Marketplace, SA property for $85m representing a 6.1% premium to book value.

The Australian residential property market experienced an increase of +0.9% Month on Month (as represented by CoreLogic’s five capital city aggregate). Brisbane and Adelaide were the biggest movers (both +1.4%) with Perth (+1%) also performing strongly. All five capital cities performed positively for the third consecutive month.

Fixed Income

In its July meeting, the RBA decided to leave the cash rate on hold at 4.1%, pausing what has been an aggressive rate hiking cycle. The market responded with Australian 2-Year and 10-Year bond yields remaining elevated and rising by 4bps and 5bps respectively. Fixed income markets started to see some gains, with the Bloomberg AusBond Composite 0+ Yr Index returning 0.5% over the month.

In the US, bond markets continue to price the possibility of a recession and the US yield curve is inverted. The Federal Reserve raised rates in July by 25bps lifting the benchmark rate to 5.25-5.5%, which is the highest this range has been in 22 years. The market responded with US 10-Year and 2-Year Treasury yield rising by 15bps and 9bps respectively. US annual inflation for the year to June 2023 lowered to 3%. Globally, higher yields led to losses in fixed income markets, with the Bloomberg Barclays Global Aggregate Index (AUD) returning -0.5% over July.

Economic key points

- The IMF raised its global growth forecast for 2023 to 3%. It also predicts inflation to fall to 8% this year and 5.2% in 2024.

- RBA maintained the cash rate at 4.1%.

- Both the Fed and ECB raised the cash rate by 25bps in their July meetings to 5.50% and 4.25% respectively.

Australia

The RBA left the cash rate at 4.1% in its July meeting with the Board saying that it needs more time to assess the impact of past hikes. Annual inflation dropped to 6% in Q2, below the forecast 6.2%, primarily driven by a slowdown in goods inflation (5.8%). Services inflation came in at 6.3%, the highest rate since 2001.

The Westpac-Melbourne Institute Index of Consumer Sentiment for June rose by 2.7% to 81.3. Although the reported fall in inflation appears to have boosted confidence, the index remains in deeply pessimistic territory.

The unemployment rate eased to 3.5% in June, against the expected 3.6%. Retail sales in June declined 0.8% as cost-of-living pressures continued to weigh on consumer spending. Conversely, annual sales rose 2.3%, down from +4.2% the previous month.

The Composite PMI fell to 48.2 in July amid a renewed contraction in the service sector as interest rate rises hit customer confidence and budgets. The NAB business confidence index rose to 0 in June but shows warning signs of growth. In trend terms, confidence is weakest in retail and is also negative in wholesale and recreation & personal services, reflecting concerns about the outlook for consumption.

The trade surplus widened to $11.32 billion in June from a downwardly revised $10.49 billion in May, beating market forecasts of $11 billion.

Global

The International Monetary Fund (IMF) slightly raised its global GDP growth estimates for 2023 to 3%, however it continues to warn about persistent challenges over the medium term. The latest World Economic Outlook from the IMF points to reduced inflation as a factor in the improved outlook for 2023 but has kept its 2024 forecast unchanged – both standing at +3%.

India is expected to have the world’s highest growth rate this year at 6.1%.

The IMF also forecasts that global headline inflation will drop to 6.8% for 2023, down from 8.7% last year, with inflation predicted to fall to 5.2% next year. However, core inflation is likely to drop more slowly and not back in line with national targets until late 2024 or early 2025.

US

The Federal Reserve raised the cash rate by 25bps to 5.50% in its July meeting, bringing borrowing costs to the highest levels since January 2001.

Inflation rose 0.2% in June, slightly below the 0.3% the market expected, with the annual rate slowing to 3.0%.

Non-farm payrolls added only 187,000 jobs in July, below the forecast 200,000. The unemployment rate dropped to 3.5% in May, below the market expectation of 3.6%. This jobs data is largely supportive of the soft-landing narrative and is unlikely to influence Fed expectations. Consumer Confidence continued its bounce back, rising to 117.0 in July and likely reflecting lower inflation and a tight labour market.

Retail sales in June increased 0.2%, below the expected 0.5% with the annual rate increasing by 1.5%. The S&P Global Composite PMI declined to 52.0 in July, dragged down by slower service sector growth.

The trade deficit narrowed to US$65.5 billion in June, with China trade accounting for US$22.8 billion of this figure.

Euro zone

In July the European Central bank raised the key interest rate by 25 bps to 4.25%, citing persistently high inflation. At the same time, the annual inflation rate dropped to 5.3%, in line with market estimates.

Unemployment dropped slightly in June to 6.4, just under the market forecast.

Consumer confidence rose to -15.1 in July, the highest rate since February 2022. Retail sales dropped 0.3% in June, missing market expectations of + 0.2%. The annual rate was down 1.4%, ahead of the anticipated -1.7%.

The Composite PMI dropped to 48.9 in July, as new business inflows fell the most in eight months and backlogs of work dropped at the steepest rate in ten years. PPI dropped 0.4% in June, double the market expectations, with the annual rate falling 3.4%, against the forecast -3.1%. These drops were primarily driven by the decrease in energy costs.

Europe is counting the cost of fires across Greece, Spain and Portugal, as a ‘heat dome’ across the southern half of the continent led to the hottest temperatures on record.

UK

There was no meeting of the Bank of England in July, so the cash rate remained at 5.0%. Annual inflation slowed to 7.9% in June, the lowest level in a year. Inflation remains well above the 2% target rate and therefore, the Bank of England is expected to raise rates at its next meeting in early August.

Annual PPI fell by 2.7% in June, more than the market forecast of -1.6%.

The unemployment rate rose to 4.0% in May, above market expectations of 3.8%.

Consumer confidence fell to -30 in July as persistent inflation and rising interest rates weigh on sentiment. Retail sales rose 0.7% in June, above the anticipated 0.2%, boosted by summer sales and good weather.

Annual sales fell 1%, above the expected -1.5%.

The composite PMI index fell to 50.8 in July, mainly due to a sharp fall in manufacturing orders.

China

The Chinese economy expanded by 6.3% year-on-year in Q2 2023, faster than the 4.5% of the previous quarter but falling short of market estimates of 7.3%. The latest figures are distorted by a low base of comparison from last year when Shanghai and other major cities were under strict lockdowns.

The unemployment rate was unchanged at 5.2% in June, in line with market forecasts and below the government target rate of 5.5%.

Annual retail sales increased by 3.1% in June, below the forecast 3.2%, as sales for clothing, footwear and textiles slowed considerably.

Composite PMI fell to 51.9 in July, with manufacturing contracting for the first time in three months and services activity expanded at a slower pace.

China was hit hard by extreme weather in July from record-breaking heatwaves to deadly rain, with at least 20 people killed and 31,000 evacuated in Beijing due to severe flooding.

Japan

As expected, the Bank of Japan kept its key short-term interest rate unchanged at -0.1% and that of 10-year bond yields at around 0% in its July meeting. The Bank also made a surprise move by making its yield curve control policy more flexible in an effort to improve the sustainability of stimulus policy.

The annual inflation rate increased slightly to 3.3% in June, below the forecast 3.5%.

The unemployment rate came in at 2.5% in line with expectations and improving from a prior reading of 2.6%.

The consumer confidence index rose above forecasts to 37.1 in July, as the economy further recovered from pandemic disruptions. Retail sales fell 0.4% in June, with the annual rate rising 5.9%, which matched forecasts.

The composite PMI came in at 52.2 in July mainly underpinned by a solid expansion in the services sector. Factory activity remains subdued with both output and new orders falling.

Currencies

The Australian dollar (AUD) fell over the month of July, closing -0.7% lower in trade weighted terms to 61.3.

Key volatility drivers over the month of July included weaker than expected CPI and PPI data releases in the US, bolstering spirits that the Fed may be approaching its final rate hike for the cycle. In addition, softer Q2 CPI data released domestically caused the AUD to retreat on gains made earlier in the month.

Relative to the AUD, the Japanese Yen (JPY) led the pack in July, appreciating by 0.6%. Conversely, the US dollar (USD) was the laggard of the month, falling by – 0.9% relative to the AUD. Year-on-year, the AUD remains behind the Euro (EUR), Pound Sterling (GBP) and USD by -10.6%, -8.9% and -3.7% respectively, and remains ahead of the JPY by 2.6%.