Knowing how your mind works can help you avoid the more obvious traps many investors fall into.

Knowing how your mind works can help you avoid the more obvious traps many investors fall into.

A good estate plan will help make sure your wishes are carried out when you die. It can also help if you become unable to make your own decisions.

We all approach decision-making in our own way, making a multitude of decisions every day

How can you make the most of your savings? In this interview, Andrew Sherlock and Victoria Sherlock explore the different options for young people regarding investing their savings.

How can you create a superannuation portfolio that works to your advantage? Andrew Sherlock shares with his daughter, Victoria Sherlock, how young people can manage their superannuation portfolio, touching on salary sacrifice and insurance.

How do you know whether you have the right insurance cover to suit your needs. In this start.smart video, Andrew Sherlock and Victoria Sherlock explore the types of life insurance young people should be covered by and when they should look to get covered.

How can you reach your savings goals sooner? In this interview, our marketing associate Victoria Sherlock interviews her dad and Head of Advice, Andrew Sherlock, on the steps young people can take to create a budget and manage their cashflow.

With the tax regulator taking a more aggressive approach to tax debts and reviewing work from home deduction rules, tax issues could become a higher priority in 2022-23.

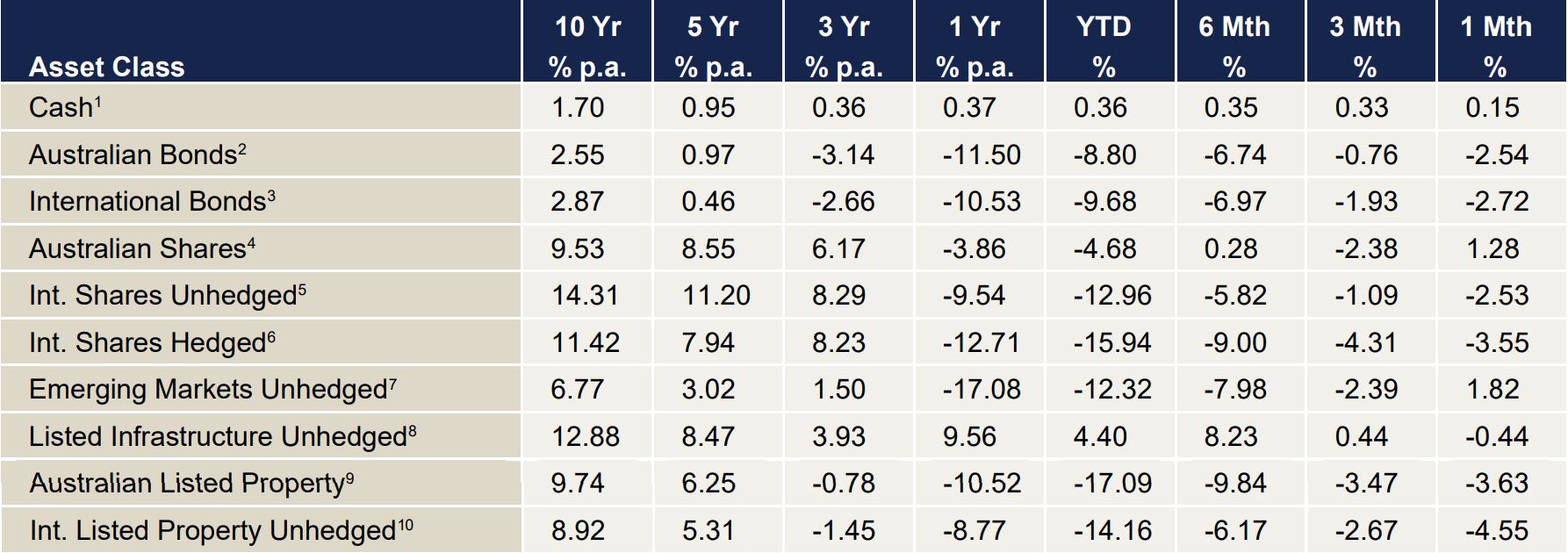

1 Bloomberg AusBond Bank 0+Y TR AUD, 2 Bloomberg AusBond Composite 0+Y TR AUD, 3 Bloomberg Barclays Global Aggregate TR Hdg AUD, 4 S&P/ASX All Ordinaries TR, 5 Vanguard International Shares Index, 6 Vanguard Intl Shares Index Hdg AUD TR, 7 Vanguard Emerging Markets Shares Index, 8 FTSE Developed Core Infrastructure 50/50 NR AUD, 9 S&P/ASX 300 AREIT TR, 10 FTSE EPRA/NAREIT Global REITs NR AUD

Source: Centrepoint Research Team, Morningstar Direc

Global growth concerns rose during August with many forecasters revising their estimates for regional and global economic growth lower, this saw US, Europe and Japan all declining in local currency terms. Unhedged returned -2.72%, whilst hedged returned -3.55% across the month, which was in stark contrast from last month’s strong returns. The key drivers were the risks of rising interest rates, inflation surging in Europe, and lastly weaker consumer and business sentiment (as shown by the Markit PMI surveys).

Australian shares stood out in August posting a positive 1.28% gain for the month. Earnings season was broadly well received with most stocks reporting positive earnings and sales surprises versus consensus estimates. The local technology sector disappointed slightly with Computershare missing on its earnings estimates. While Australia isn’t immune to rising energy prices, broad inflation (including wage growth) has remained more contained than is the case in the US for example. The labour market continues to hold up well and despite weaker consumer confidence, retail spending has also held up with discretionary consumer businesses performing well in the August 2022 reporting season, particularly amongst “bricks and mortar” retailer businesses.

Negative returns within both Australian and International bonds occurred across the month (-2.54% and -2.72%, respectively). The bulk of the damage came following Federal Reserve Chairman Powell’s remarks on US monetary policy. His clear conviction was that the Fed’s task on inflation was still incomplete. This carried the implication of more rate rises being necessary. The pace of RBA hikes, however, is beginning to show meaningfully signs of weakening the economy. Credit growth is a leading indicator of house prices. The current trend suggests a meaningful correction is already underway and has more scope to continue. The negative impact on household wealth is likely to drag further on sentiment and ultimately spending.

The Australian Dollar (AUD) almost completed a round trip in August (AUD/USD). Starting the month of August at 0.7344 and ending August at 0.7316. Weakness in the Australian Dollar was caused by sharply falling commodity prices due to the slowdown of demand from China. The US dollar had a mixed run over the month of August. We saw a fall in the middle of the month due to stronger than expected payroll numbers and potential US interest rate cuts. This was then reversed following the speech at Jackson Hole by US Federal Reserve Chair Jerome Powell who reiterated that the Federal Reserve would continue to rase rates and fight inflation. This saw the US Dollar rise as it continues to be a haven asset for investors.

Disclaimer

The information provided in this communication has been issued by Centrepoint Alliance Ltd and Ventura Investment Management Limited (AFSL 253045).

The information provided is general advice only has not taken into account your financial circumstances, needs or objectives. This publication should be viewed as an additional resource, not as your sole source of information. Where you are considering the acquisition, or possible acquisition, of a particular financial product, you should obtain a Product Disclosure for the relevant product before you make any decision to invest. Past performance does not necessarily indicate a financial product’s future performance. It is imperative that you seek advice from a registered professional financial adviser before making any investment decisions.

Whilst all care has been taken in the preparation of this material, no warranty is given in respect of the information provided and accordingly neither Centrepoint Alliance Ltd nor its related entities, guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution.