In this tip sheet, we share our top 10 strategies for you to consider for the end of this financial year.

In this tip sheet, we share our top 10 strategies for you to consider for the end of this financial year.

MoneySmart

(ASIC)

Some of the things you’ll need to consider when choosing an income protection policy are:

Income protection policies are provided as either an:

This is the amount of time you must wait before your payments start. Most income protection policies offer a waiting period between 14 days and two years.

In general, the longer the waiting period, the cheaper the policy. When you’re choosing the waiting period, think about how much you have in sick and annual leave, savings and emergency funds.

The benefit period is how long the monthly payments will last. Most income protection policies offer two or five years, or up to a specific age (such as 65). The longer the benefit period, the more expensive the policy. But it also means greater protection if you’re unable to work for a longer time.

You can generally choose to pay for income protection insurance with either:

Your choice of stepped or level premiums has a large impact on how much your premiums will cost now and in the future.

If you would like to discuss what income protection options are available for you, please reach out to the Sherlock Wealth team to discuss your unique situation here

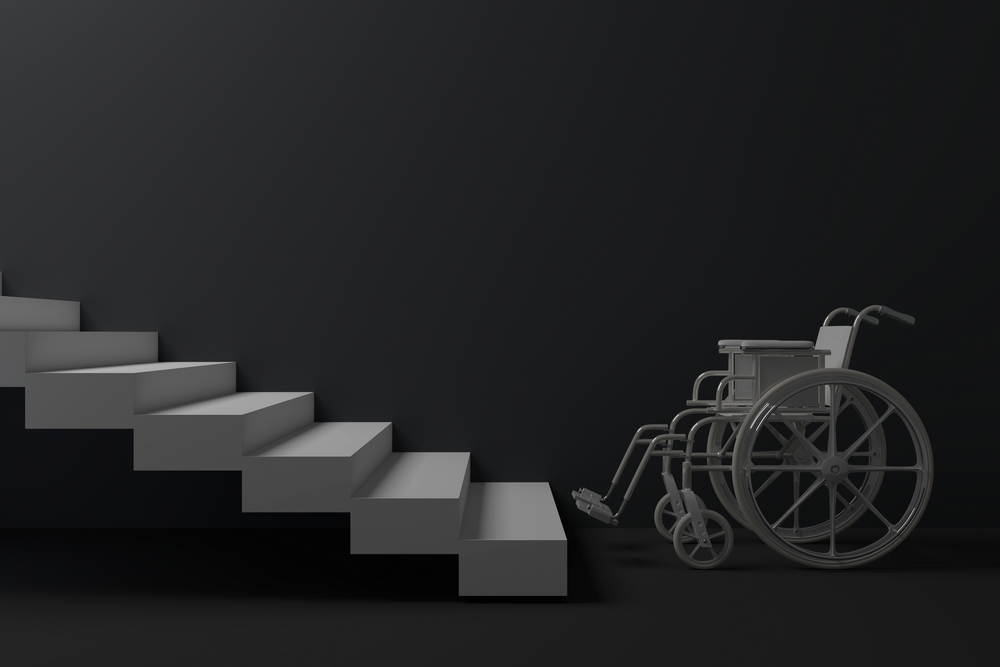

A permanent injury or illness can make it difficult or impossible to return work. TPD insurance can provide a financial safety net to help support you and your family, and pay for medical and rehabilitation costs.

TPD insurance pays a lump sum if you become totally and permanently disabled because of illness or injury.

Each insurer has a different definition of what it means to be totally and permanently disabled. It can cover you for either:

Read the product disclosure statement (PDS) so you know how your insurer defines a total and permanent disability. Call the insurer or your super fund if you have questions about the policy.

When deciding if you need TPD insurance, and how much, think about the expenses you’ll need to cover if you were permanently disabled and unable to work. These could include:

Also, think about what you have that could help pay for these costs. This could include:

The gap between the amount you have and the amount you’ll need can be a guide as to how much TPD cover you may need.

If you need help deciding if you need TPD insurance, and how much, speak to a financial adviser.

Check if you already hold TPD insurance through your super. Most super funds offer default TPD cover that’s cheaper than buying it directly. You can increase your level of cover through your super fund if you need to.

You can also buy TPD insurance from:

TPD insurance can be bought on its own or packaged with life cover. If it’s packaged, your life cover may be reduced by any amount paid out on a TPD claim. Check the PDS or ask your insurer.

Before buying, renewing or switching insurance, check if the policy will cover you for claims associated with COVID-19.

You can generally choose to pay for TPD insurance with either:

Your choice of stepped or level premiums has a large impact on how much your premiums will cost now and in the future.

Before you buy TPD insurance, compare policies to make sure you get the right one for you. Check:

A cheaper policy may have more exclusions, or it may become more expensive in the future.

Use our Life insurance claims comparison tool

Compare how long different insurers take to pay a TPD claim and the percentage of claims they pay out.

You need to tell your insurer anything that could affect their decision to provide you with TPD insurance. You need to give them this information when you apply, renew or change your level of cover.

Insurers usually ask for information about your:

If an insurer doesn’t ask for your medical history, it may mean their policy has more exclusions or narrower policy definitions.

The information you provide will help the insurer to decide:

It is important that you answer the questions honestly. Providing misleading answers could lead an insurer to decline a claim you make.

Please reach out to the Sherlock Wealth team to discuss what insurance cover you may need here.

MoneySmart

(ASIC)

Investing in recovery In his third and possibly last Budget before the next federal election,…

If you’ve recently split from your partner or are simply wondering what might happen if you do, you’ll need to keep your financial wits about you. A division of assets and debts, whether they’re held separately or together, may be on the cards.

Here are some of the things to be aware of when it comes to de facto splits and your finances.

A de facto relationship, according to Australian family law, is where two people of the same or opposite sex live together on a genuine domestic basis as a couple. You can’t be married to each other or related by family.

Not all de facto couples have to divide property of the relationship (that’s your assets and debts) when they break up. However, depending on your situation, this may be the case and can be formalised between the two of you without any court involvement.

If you can’t agree though, you can apply to a court for financial orders regarding the division of property and possibly superannuation, while spouse maintenance might also be payable in some circumstances.

This must be done within two years of you splitting from your former partner, otherwise, you’ll need special court approval to make an application.

The family law courts can order a division of any property you and your de facto own (regardless of whether you own it together or separately) if they’re satisfied of one of the following:

Property includes all assets and debts held in joint or separate names and may include things you acquired before or even after the relationship ends. This could include things like:

Under superannuation splitting laws, if you separate, it’s possible you’ll get some of your ex-partner’s super or that they’ll get some of yours.

However, because super is held in a trust and differs from other types of property, there are rules around when these assets can be accessed.

What this means is, splitting super doesn’t necessarily convert it into cash as it’s still subject to certain rules, which may mean that you mightn’t be able to access the money for a long time.

Seek financial advice to help you understand the long-term outcomes of different settlement options. Please reach out to the Sherlock Wealth team to discuss your unique situation here

Source: AMP

Treasury chief Steven Kennedy believes few countries have experienced what Australia has achieved in responding to last year’s recession – relatively good health outcomes, smaller economic impacts and now, rapid recovery.

“By any measure, Australian governments have struck the right balance,” Dr Kennedy told senators in Canberra.

“Our outcomes have been world leading, both in the health and the economic sphere.”

He said the economy has now recovered 85 per cent of the decline from its pre-COVID level of output.

“Growth will now begin to moderate as we move past the initial phase of the recovery,” he told a Senate estimates hearing on Wednesday.

“While the economy is recovering strongly, well supported by fiscal and monetary policy settings, we are well below our pre-pandemic economic growth path and it will take some time to fully recover.”

He said the peak in unemployment now appears to have passed following strong employment gains in recent months.

In the mid-year budget review released in December, Treasury had predicted the unemployment peaking at 7.5 per cent in the March quarter.

Instead, the unemployment rate has steadily fallen, dropping to 5.8 per cent in February.

“Nonetheless, while outcomes to date have tended to surprise on the upside, there is still significant spare capacity in the labour market,” Dr Kennedy said.

New figures show there remains strong demand to hire staff with job advertisements posted on the internet jumping by a further seven per cent in February to be 24.8 per cent over the year.

This is the 10th straight month job ads, as compiled by the National Skills Commission, have risen after striking a record low in April 2020 and the depths of last year’s recession.

Job ads grew in all eight broad occupational groups monitored by the commission and recruitment activity increased across all states and territories.

But Dr Kennedy expects the number of people defined as being in long-term unemployment – those who have been looking for but been without, paid work for a year or more – will jump in coming months.

“This reflects the flow-on impacts of the spike in unemployment at the onset of the crisis in March and April last year,” he said.

Meanwhile, Australia recorded its third consecutive goods trade surplus above $8 billion for the first time in history.

Preliminary trade figures show exports grew by two per cent in February, buoyed by a record $1.3 billion of cereals exports, which helped offset a 12 per cent decline in iron ore shipments to China.

Imports also grew by two per cent, led by a 24 per cent increase in road vehicle inbound shipments.

Colin Brinsden, AAP Economics and Business Correspondent

(Australian Associated Press)

Income protection can be the financial safety net you need if you experience an accident or illness that means you can no longer work. A common misconception about income protection insurance is that it’s only for high-income earners, but this isn’t the case.

Income protection insurance is a source of income paid out to you if you are temporarily unable to work due to an illness or injury.

Nobody wants to consider an accident or illness impacting their health suddenly, but it’s always a possibility. As well as changing your lifestyle, an unexpected illness could mean you need to take an extended leave from work. In a 2020 report by the Australian Institute of Health and Welfare (AIHW) on an average day, 100 Australians suffer from a stroke that could leave them permanently out of work. The AIHW also reports that accidental falls were the most common cause of injury deaths. It’s tempting to think that if you lead a healthy lifestyle and make smart choices, you’ll be fine. But the reality is you can’t predict the future, you can only plan for it.

Then there’s the trap of thinking life insurance is all you need. An unexpected death is absolutely a part of life we should all plan for. But an unforeseen total or partial disability due to injury or illness is a debilitating situation that can stop you from earning a living and is equally unwise to overlook.

Most super funds offer income protection insurance for their members which can be a cheaper option. But cheaper premiums can come with a limited level of cover. Moneysmart by the Australian Securities & Investments Commission notes that “insurance premiums through super are deducted from your super balance which reduces your savings for retirement” so it’s important to consider if separate income protection cover is right for you and your family’s needs. For more information on whether life insurance through superannuation is enough, read here.

So, how does income protection insurance cover you? Up to 75% of your monthly income is provided for a nominated period to help keep your household up and running and provide for your loved ones while you recover. In a nutshell, it gives you the freedom to rest easy knowing you’ll be taken care of financially.

An inability to keep up with the mortgage, loan or credit card repayments can cause considerable stress when you’re unwell. It’s crucial to focus on recuperation at such a time, with full confidence that these debts can be provided for under your policy.

Your income is fundamental to achieving your financial goals, so for financial security, you should be confident that you have adequate protection and plans in place. To discuss your financial plan, or to take out cover to protect you and your loved ones if something unexpected did occur, please reach out to the Sherlock Wealth team to discuss your unique situation here

Any advice is general in nature only and has been prepared without considering your needs, objectives or financial situation. Before acting on it you should consider its appropriateness for you, having regard to those factors.

How much do you need to save to make sure you have enough to last throughout retirement? It very much depends on what your living costs will be after leaving work. Find out more about how to budget for the retirement income you’ll need for the lifestyle you’re planning for.

When you plan to retire will often be determined by whether you can afford to stop working and still have enough income to maintain your lifestyle. Figures from the Australian Bureau of Statistics[1] show the majority of men (36%) and women (22%) chose to retire at the time when they became eligible to draw on their superannuation and/or the age pension. And their average age at retirement was 63.5 years.

If you’re planning to delay retirement until your super balance reaches an amount you can comfortably live on, just how do you determine what that target should be? There are a number of factors that will affect how far your money will go, including your life expectancy, how your money is invested and other choices you make for managing your income. But one of the most important steps to planning for a secure financial future in retirement is to be realistic about your living costs.

How your living costs might change

As you stop working and have more time to yourself, your routine will change and you might save on some costs as a result. Spending on transport could fall as you no longer have to commute. If buying lunch and takeaway coffees have been a daily habit while working, you could also make significant savings by leaving these out of your retirement routine. Other living expenses, such as buying groceries and clothes and paying household bills are likely to be much the same before and after retirement.

Thinking about how you’ll spend time in retirement and where you’re planning to live will also give you clues about how your spending might go up or down. If a few trips overseas are on the cards, you’ll need to allow for these occasional costs in your overall budget. But if you’re planning to limit travel to domestic holidays only, then you won’t need to allow for these expenses in your financial plan.

Start with a ballpark estimate

How much travel you plan to be doing is just one of the many daily and one-off costs taken into account in the Retirement Standard estimates for annual expenses. Updated every quarter by the Association of Superannuation Funds of Australia (ASFA), these figures can give you a rough idea of what you can expect to be spending day-to-day in retirement.

There are two estimates available, a higher one for a comfortable lifestyle and a lower amount for a modest lifestyle. As at December 2018, the amount you’d spend as a single person aged around 65 years enjoying a comfortable lifestyle is $43,317 and for a modest lifestyle, the annual budget is $27,648. The estimate for couples is $60,977 and $39,775 for comfortable and modest lifestyles respectively.

To give you an idea of how differences between a modest and comfortable budget might impact on your retirement plans, the annual travel budget is a good place to start. A couple living modestly can expect to spend approximately $2,500, with no allowance for overseas trips. On a comfortable budget, a couple can splash out more than $5,000 each year on travel, with roughly a third going towards international travel.

The cost of lifestyle changes

Although it’s wise to build a budget based on what you expect to be doing in early retirement, your overall plan should also take into account the potential for lifestyle changes as you age. Travelling for longer periods, dining out and entertainment and taking part in sports and hobbies could taper off as you grow older. Health and aged care costs, on the other hand, could make up a larger share of your budget in the later years of retirement.

A plan to see you through retirement

Your expenses are just one side of the whole budget planning process. Taking a good look at all your retirement income options is just as important to figure out how much you’ll need and when you’ll be ready to take that step. From the age pension to the equity in your home to retirement income products such as annuities and account-based pensions, there are all sorts of ways to support yourself financially towards having the lifestyle you want.

The Sherlock Wealth Team can support you in exploring these opportunities to manage your income for your whole retirement so you can make better choices for a secure financial future. Reach out to the Sherlock Wealth team to discuss your unique situation here

Source: Money and Life

(Financial Planning Association of Australia)

In this episode, Scott Charlton from Slipstream Coaching talks with Jacqui Sherlock of Sherlock Wealth and Irma Bantjes of Stratus Financial Group about leadership in professional service firms.

The government is taking action to make Australia’s superannuation system more transparent but individuals still need to take

ownership of their super and think about how the changes impact them. Super is not the set and forget savings scheme many

think it is.

Here are some of the latest changes to be aware of.

It’s not 100% official but the Government is expected to lift the Superannuation Guarantee (SG), the proportion of money

employers are required to divert to employees’ super, from 9.5% to 10.0% on 1 July 2021. The SG has been frozen at 9.5% since

2014 – lifting the rate is aimed at channelling more savings into super, which is one of the three key pillars of retirement savings.

Happy with your existing super account? Instead of being diverted into a new employer’s default super fund, as of 1 July 2021,

workers will automatically retain their super account unless they notify their employer otherwise. This change gives people a

greater voice in their choice of super account and will reduce the number of super accounts people have, which will help minimise

fees and grow balances. It’s known as ‘stapling’ and means that your super account moves with you as you change jobs.

Employers will need to take these steps when hiring a new employee:

There is a greater requirement for transparency under the latest super reforms. Super fund administrators will need to

communicate why investment decisions have been made and how these were done with the best interests of members in mind.

Fund performance will be monitored through an annual performance test and the results will be publicly available. Funds that

fail two tests will be closed to new members. Testing will begin with MySuper products in July 2021 and rolled out to all super

products from July 2022. In this context, it pays to be on top of your fund’s performance

If you need help deciding what’s right for your super, reach out to the Sherlock Wealth team to discuss your unique situation here

This information is current as at February 2021. This article is intended to provide general information only and has been prepared without taking into account any

particular person’s objectives, financial situation or needs (‘circumstances’). Before acting on such information, you should consider its appropriateness, taking

into account your circumstances and obtain your own independent financial, legal or tax advice.