Month in Review as at September 2023

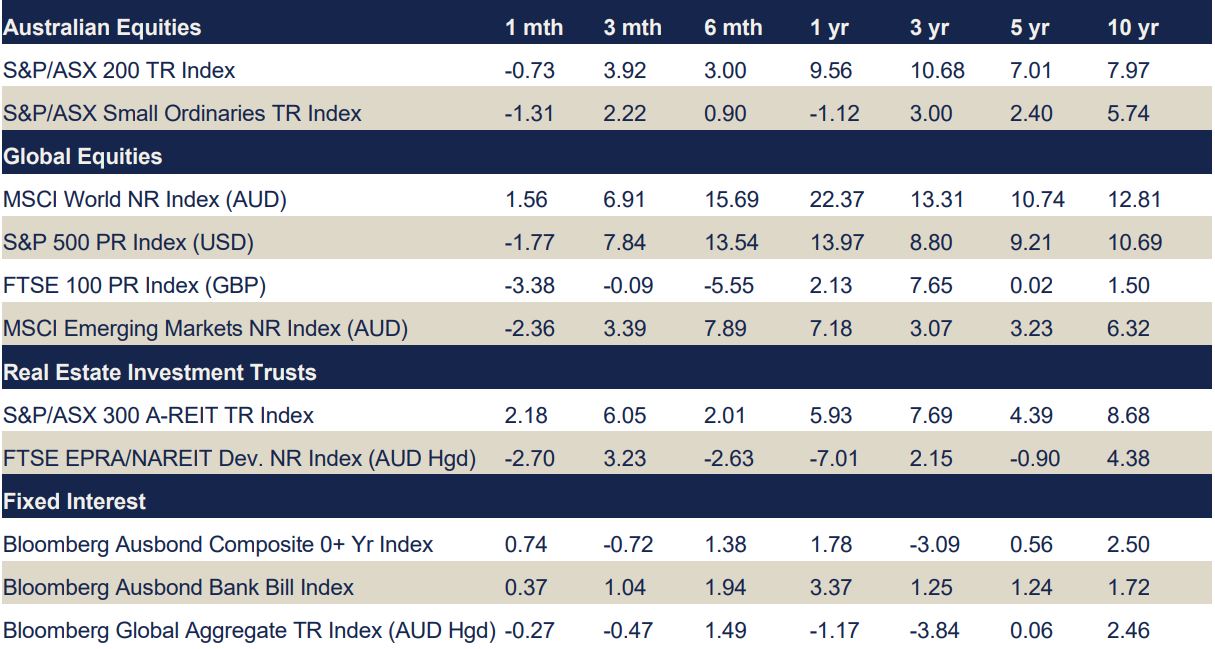

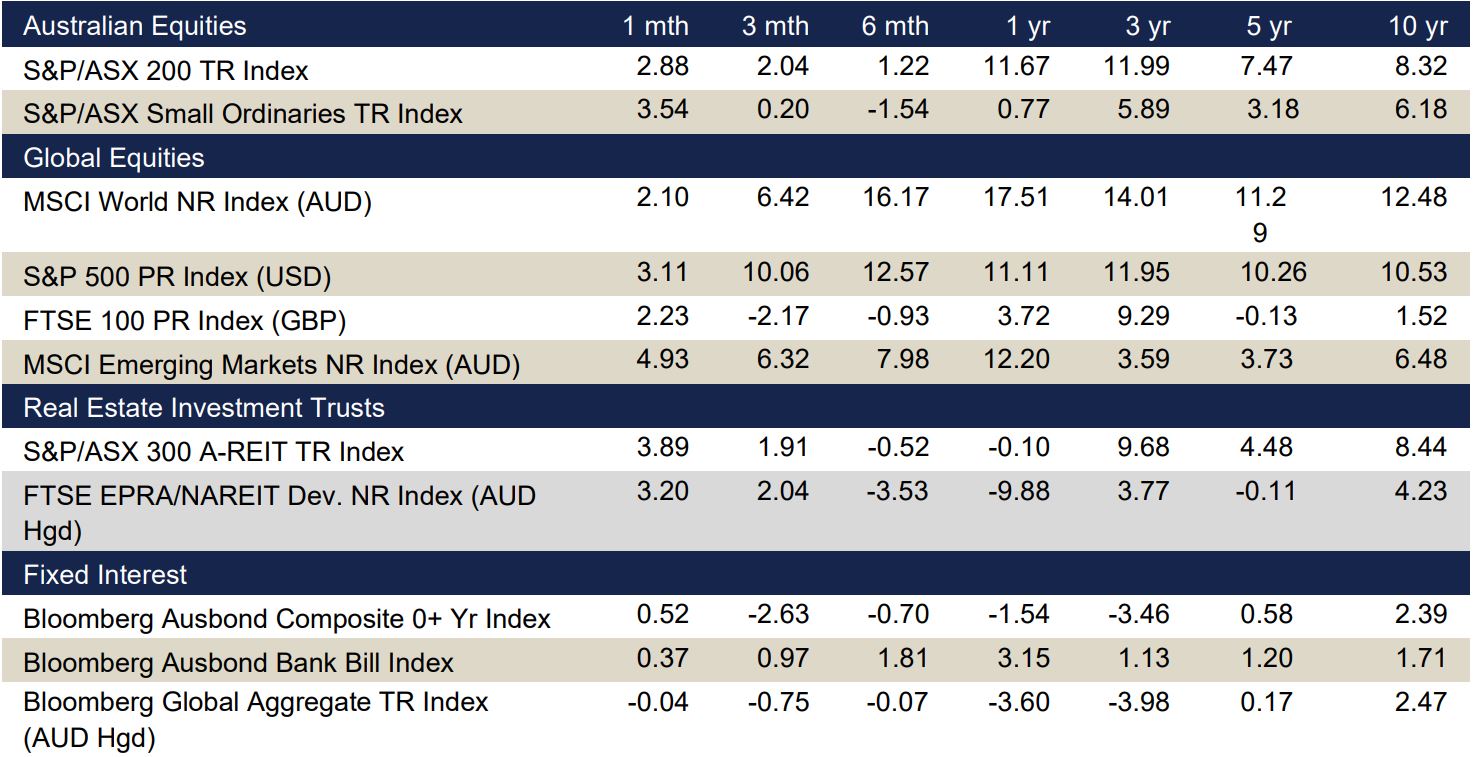

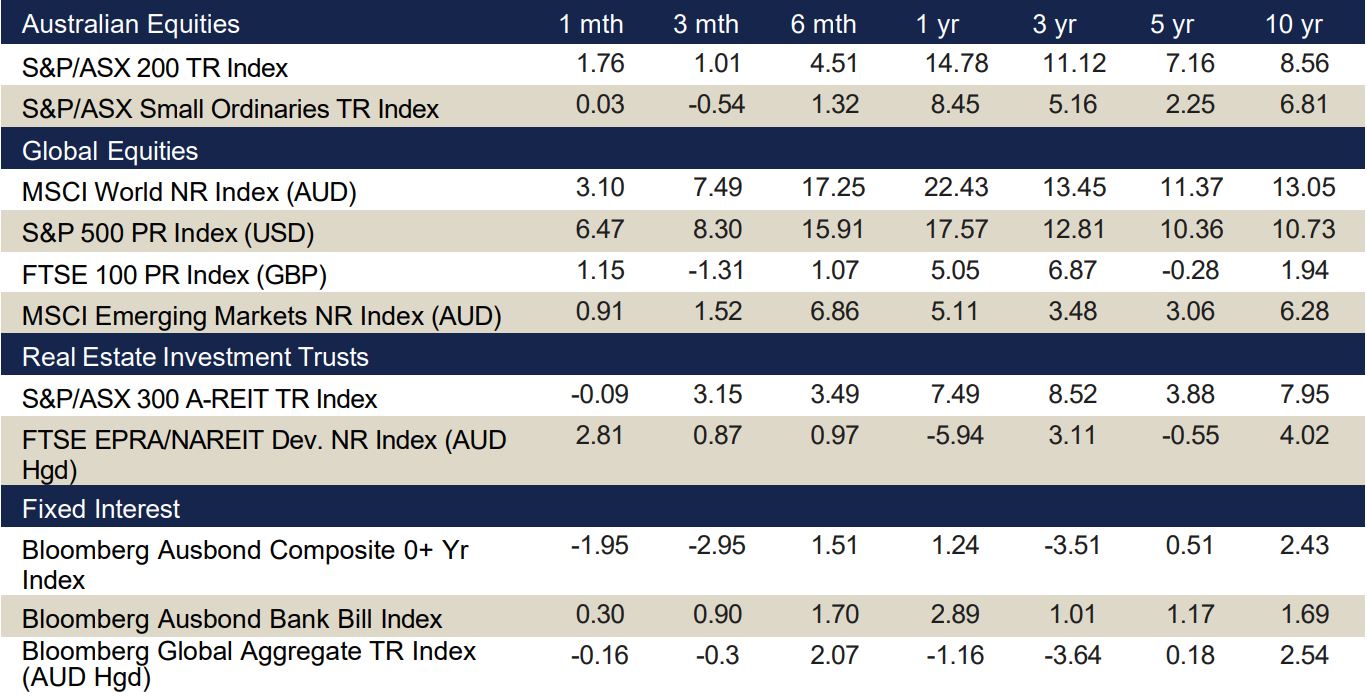

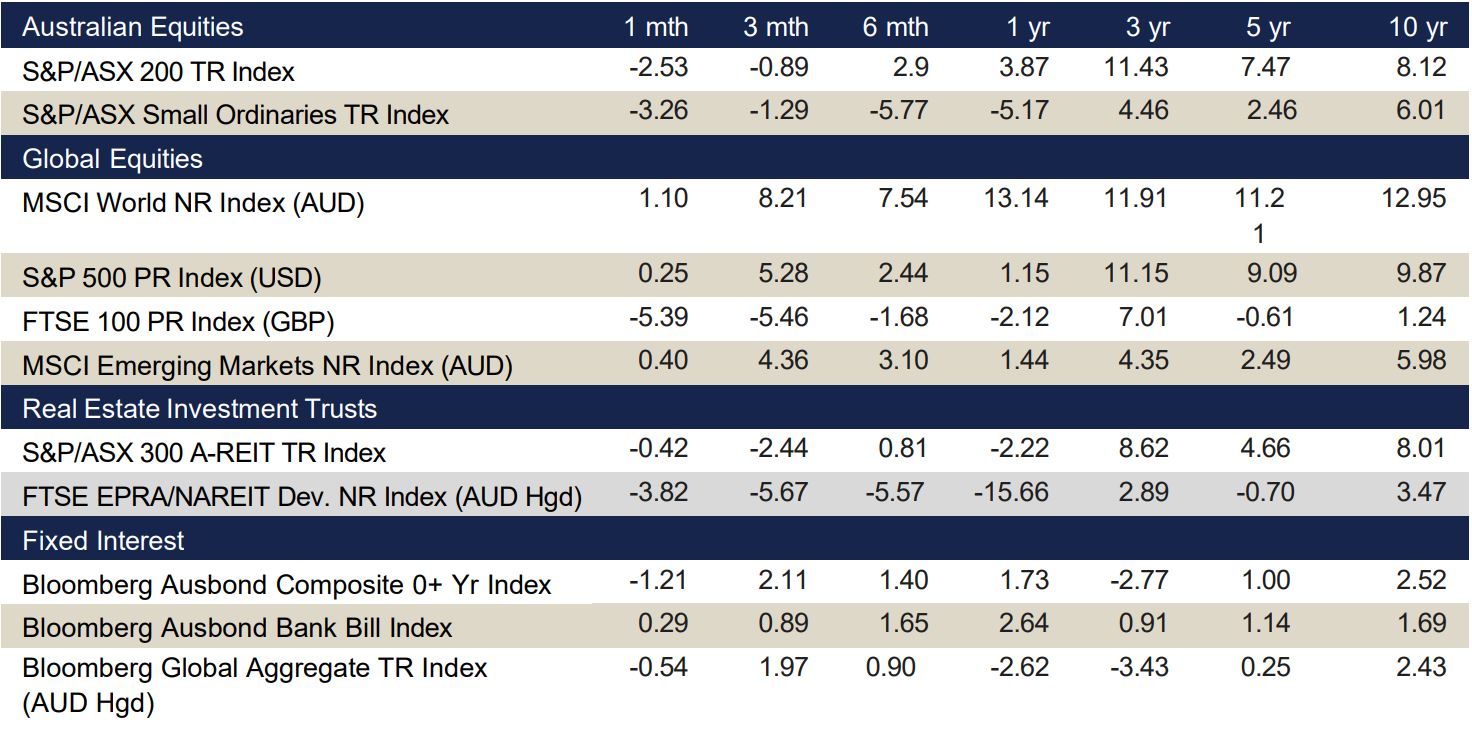

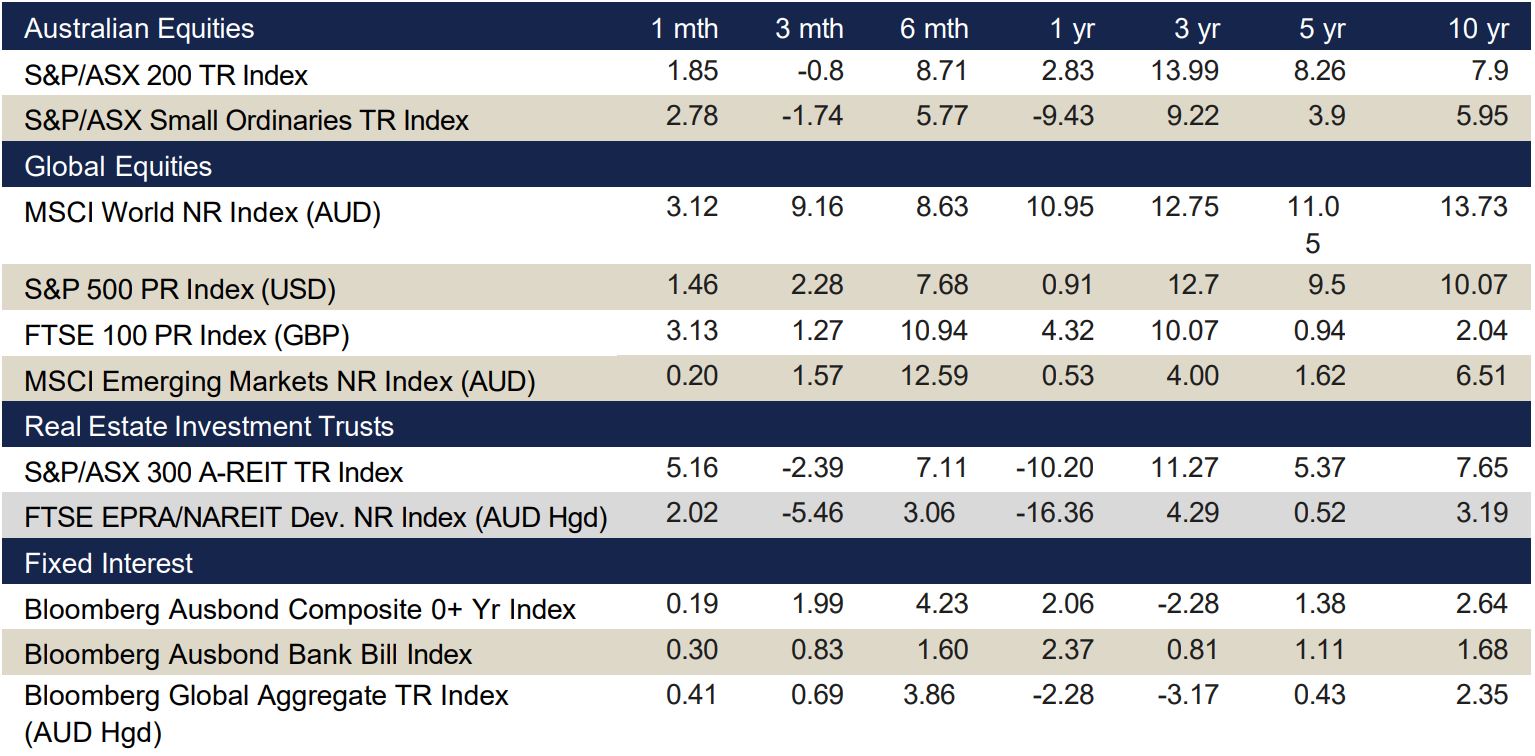

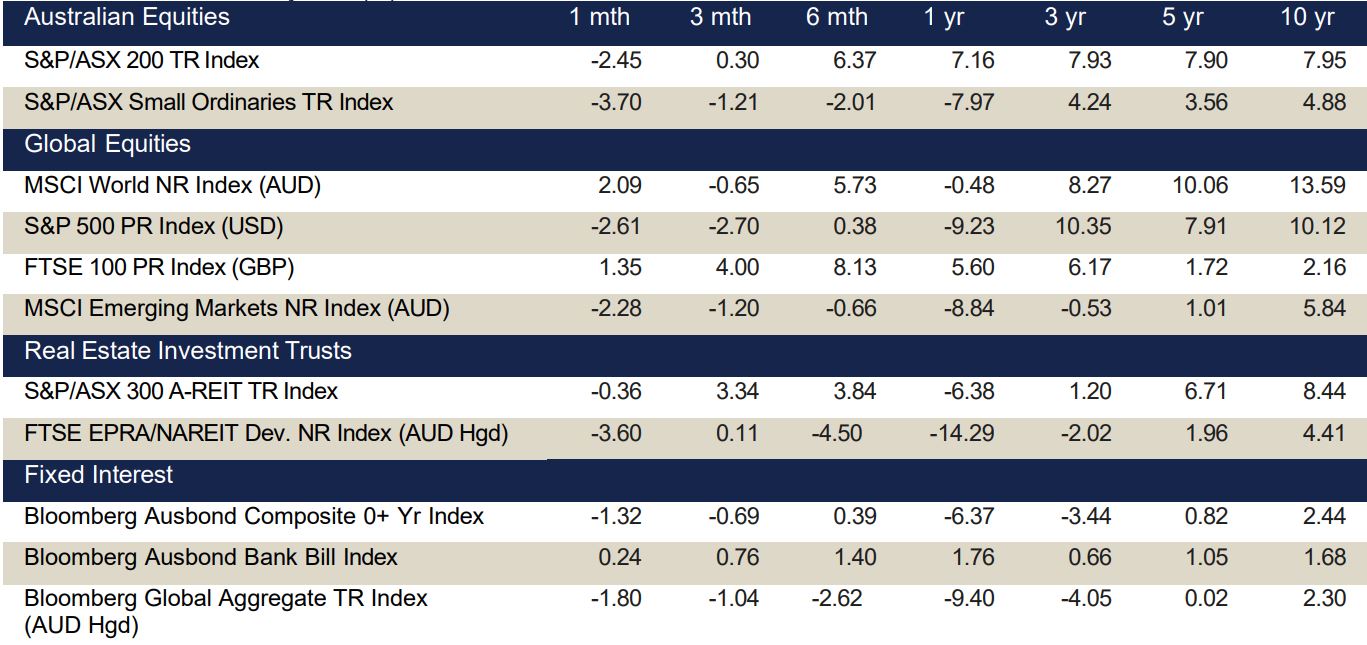

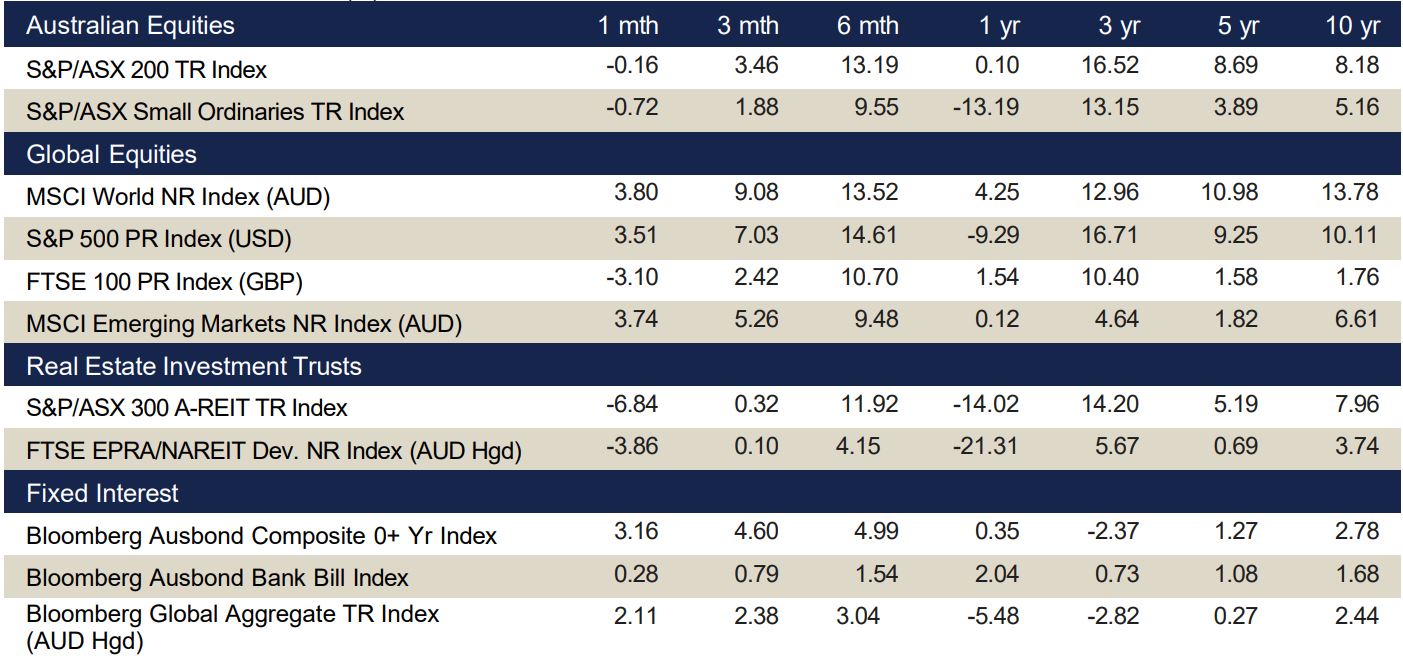

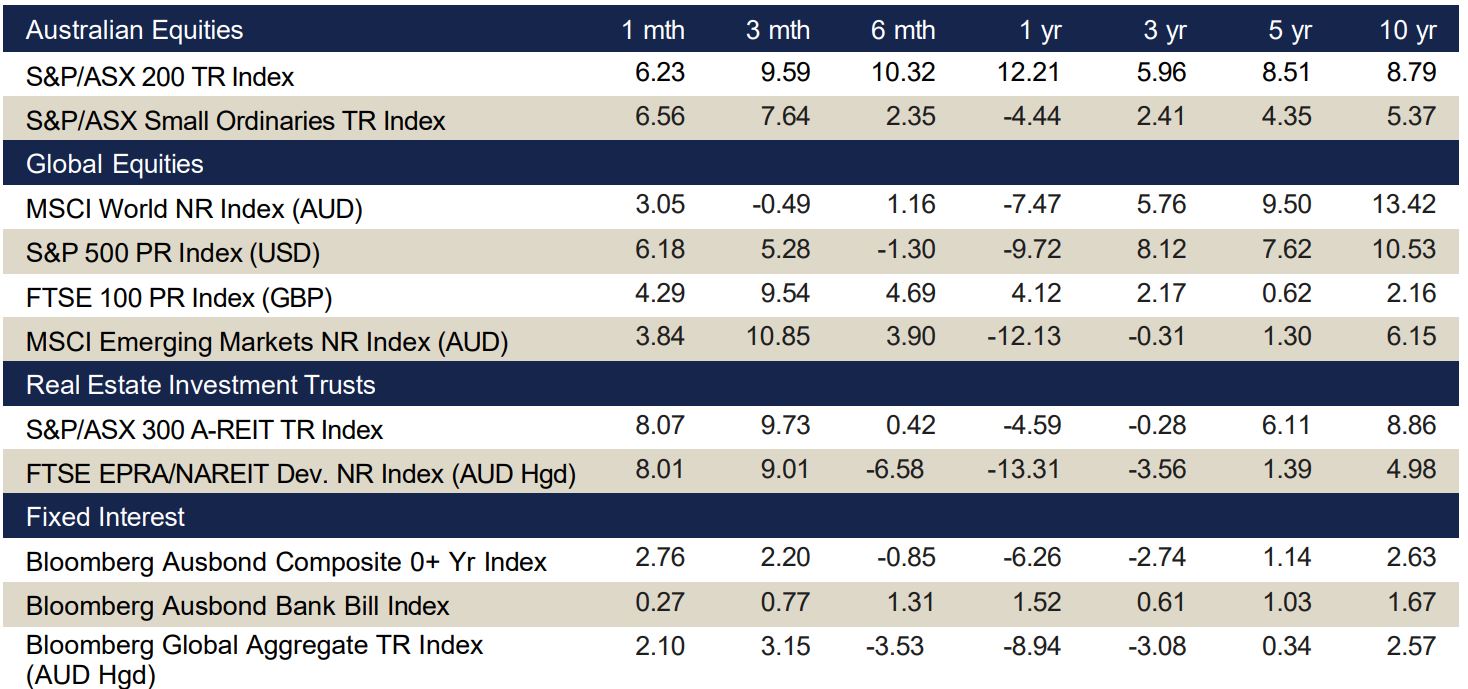

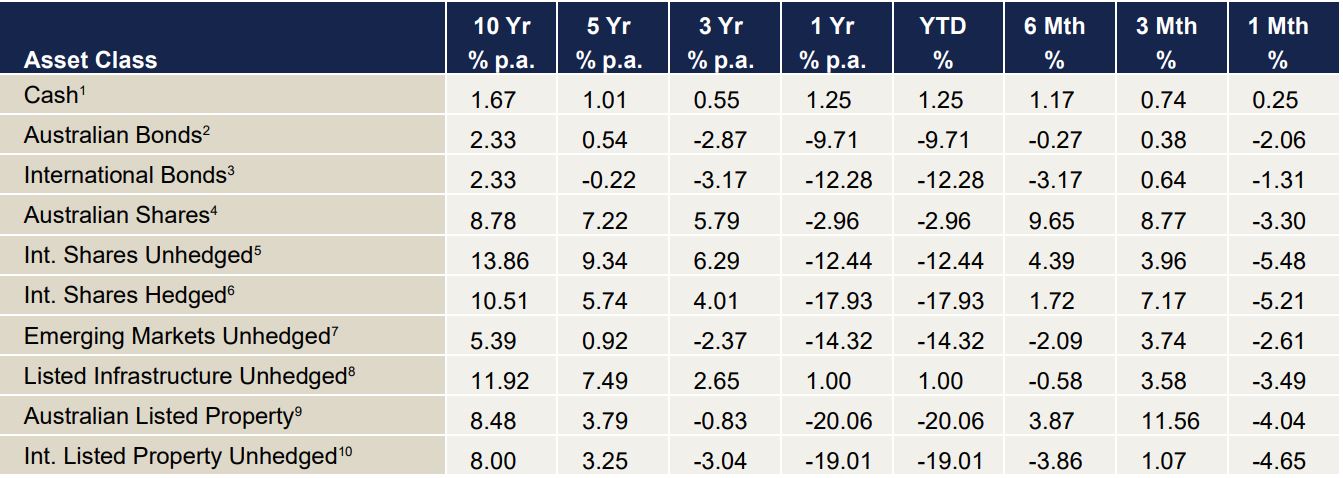

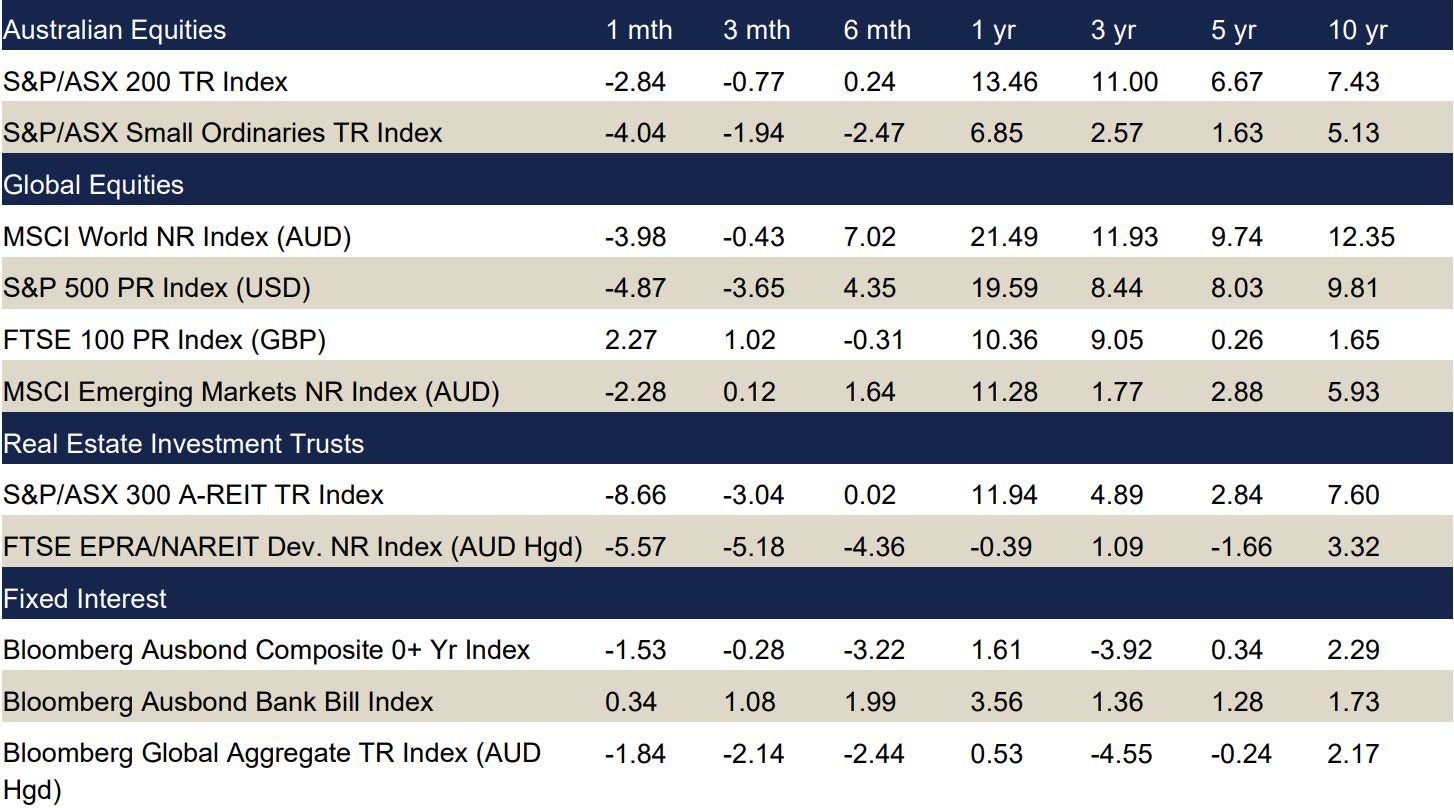

VIEW PDFIndex returns at September 2023 (%)

Data source: Bloomberg & Financial Express. Returns greater than one year are annualised.

Commentary regarding equity indices below references performance without including the effects of currency (unless specifically stated).

Market Key Points

- During September, the Australian equity market declined by 2.8%. Most sectors finished the month lower, except for Energy (+1.6%). Property (-8.6%), Information Technology (-7.9%) and Health Care (-6.2%) had the biggest declines in Australia.

- Overseas markets also declined, except for the FTSE 100 Index (GBP), which finished 2.4% higher. While acknowledging recent volatility, most global equity markets have generated moderate to strong returns over the one-year period.

Australian equities

The ASX 200 finished September down 2.8%, reflecting the losses seen globally. Energy was the only gainer (1.6%), with all the other 10 sectors finishing the month in the red. The largest drops were seen in Real Estate (- 8.6%), Information Technology (-7.9%), and Healthcare (-6.2%). However, Australian equities did manage to outperform some global markets.

Energy was the lone bright spot in the market, returning 1.6%, riding the tailwinds of rising global oil prices. In terms of laggards, the Real Estate sector was hit hard with an 8.6% drop, reflecting the “higher-for-longer” rhetoric regarding interest rates, and the potential impact on property values.

Given the potential impact of interest rates on high growth tech stocks, IT was another sector seemingly hampered by the hawkish sentiment in September, suffering losses of 7.9%. This mirrored the sell-off in US tech giants such as Apple, Nvidia, and Amazon.

Global equities

Global equities had a negative month, with September typically being the worst performing month historically for stocks. Emerging markets outperformed developed market counterparts returning -2.3% (MSCI Emerging Markets Index (AUD)) versus a -4.0% return according to the MSCI World Ex-Australia Index (AUD).

Continued negative economic data in September saw another rise in bond yields and a decrease in equity markets, with inflation falling slower than expected, primarily due to rising energy costs. US equities stumbled amid an interest rate hold and the prolonged possibility of a government shutdown, recording one of its worst months for the year with the S&P500 Index declining -4.8% (in local currency terms) during the month.

The UK was one of the few positive performers for the month, with the FTSE 100 Index returning a gain of 2.4% (in local currency terms). This was driven by a decrease in domestic core inflation and surprising GDP data above expectations. The Bank of England also kept interest rates on hold.

Property

The S&P/ASX 200 A-REIT Accumulation index finished September lower after consecutive positive months in July and August, with the index finishing the month – 8.6%. Global real estate equities (represented by the FTSE EPRA/NAREIT Developed Ex Australia Index (AUD Hedged)) also fell, returning –5.3% for the month. Australian infrastructure finished lower through September, with the S&P/ASX Infrastructure Index TR returning -1.6% for the month.

In the month of September, M&A activity was relatively quiet. BWP Trust (ASX: BWP) announced the divestment of their Wollongong property to an unrelated third party for $40mn. In broader news Charter Hall (ASX: CHC) announced their new CFO, Anastasia Clarke, following the resignation of former CFO Russel Proutt. Cromwell Property Group (ASX: CMW) announced the resignation of their CFO Michael Wilde and are yet to announce a replacement.

The Australian residential property market experienced an increase by +0.9% Month on Month (as represented by CoreLogic’s five capital city aggregate). Adelaide was the largest riser (+1.7%), followed by Brisbane and Perth (both +1.3%). All five capital cities performed positively for the fifth consecutive month with Melbourne (+0.4%) being the worst performing city. Over the one-year period, Perth was the largest gainer (+8.8%).

Fixed Income

In his final meeting as RBA Governor, Phillip Lowe kept the cash rate on hold at 4.10% for the third month running. This month’s meeting signifies Lowe’s final monetary policy decision hand down, with his seven-year term not being renewed. During his term, Lowe and the RBA board cut rates to a historic 0.1 percent, and subsequently hiked rates 12 times in a bid to control inflation. Lowe’s successor, Michele Bullock, took over the role on September 17.

The month saw a sharp repricing of bond markets with yields rising to cycle highs. Australian 2- and 10- Year Bond yields rose 25bps and 46bps respectively, and the Bloomberg AusBond Composite 0+ Yr Index returned – 1.53%. Despite inflation rates falling and economic data showing a slowing economy, bond markets appear to be repricing due to concerns central banks are expected to maintain higher interest rates for a prolonged period.

The story was similar in the US, with the Federal Reserve holding the target cash rate steady at 5.25%- 5.50% citing easing inflation pressures and concerns of slowing economic growth. Despite the rate hike respite, bond markets experienced a poor month, correlating positively with equity markets. US 2- and 10- Year Treasury yields rose 18bps and 46bps respectively, and the Bloomberg Barclays Global Aggregate Index (AUD) returned -2.58% over the course of the month.

Key economic points

- RBA maintained the cash rate at 4.1% but reiterated that inflation is still too high.

- The Fed and Bank of England held cash rates at 5.5% and 5.25%, respectively.

- The ECB bucked the trend by raising rates to 4.5%.

Australia

The RBA held the cash rate at 4.1% in September, reserving the need for increases in the coming months to ensure that inflation returns to target in a reasonable timeframe. Inflation unexpectedly rose to 5.2% in August with the most significant rises in housing, transport, food and insurance.

The Westpac-Melbourne Institute Index of Consumer Sentiment fell to 79.7 in September, with pessimism persisting, despite easing fears of further interest rates. The unemployment rate was steady at 3.7% in August, matching market forecasts. Retail sales increased by 0.2% in August, below the market estimate of 0.3%, while annual sales rose 1.5%. These figures indicate that consumers continue to rein in spending as interest rates remain elevated.

Composite PMI increased to 50.2 in September, the highest figure in four months, indicating a return to expansion for the private sector. The NAB business confidence index came in at 2 in August with sentiment mixed across industries and falling sharply in mining.

Global

The World Bank has maintained its forecast for China’s 2023 economic growth at 5.1% in line with its previous estimate in April. Their predictions were trimmed for 2024 to 4.4 per cent from 4.8 per cent, citing the persistent weakness of its property sector.

US

The US Federal Reserve held interest rates steady at 5.25- 5.5% but released an updated “dot plot” for their future trajectory which proved more hawkish than previous expectations. Many policymakers anticipate one further 0.25% increase in the remainder of 2023, and the median expectations are for only 0.5% in rate cuts through calendar 2024, compared to double this level indicated in the last dot plot. Accompanying commentary confirmed that the Fed now sees the battle to return inflation to its 2% target stretching out to 2026. Annual inflation rose to 3.7% in August, above the expected 3.6%.

The US economy added 336,000 jobs in September, nearly double the anticipated 170,000. The unemployment rate was static at 3.8% in September. The labour market remains tight, adding leeway for the Federal Reserve to leave borrowing costs at restrictive levels for a prolonged period.

Consumers remain unsure about the economic outlook with consumer confidence edging up to 68.1 in September, but below the high of 71.6 in July. Retail sales in August increased 0.6%, beating the 0.2% forecast, with the annual rate increasing by 2.5%. The S&P Global Composite PMI fell to 50.1 in September, the fourth consecutive decline, suggesting broad stagnation in the private sector. The trade deficit narrowed to US$58.3 billion in August, better than the forecast US$62.3 deficit.

Euro zone

The European Central Bank raised interest rates to 4.5%, the 10th consecutive rise. This signals a possible end to policy tightening, as inflation has started to decline but is still expected to remain too high for too long.

Annual inflation fell to 4.3% in September, below the market consensus of 4.5%. The ECB forecasts average inflation at 5.6% in 2023 and 3.2% in 2024, both higher than previous estimates, primarily due to an elevated path for energy prices. PPI rose 0.6% in August, in line with market expectations, with the annual rate falling 11.5% as energy costs continue to fall.

Unemployment came in at 6.4% for August, matching the market forecast. Consumer confidence dropped to -17.8 in September, as households remain pessimistic about both their own and the wider economic outlook. Retail sales dropped 1.2% in August, compared with market expectations of -0.3%, with the annual rate down 2.1%, below the anticipated -1.2%. The Composite PMI rose to 47.1 in September, with a steep contraction in the manufacturing sector.

UK

The Bank of England held rates at 5.25% in September as policymakers opted for a wait-and-see approach, with inflation and labour data suggesting the accumulated impacts of previous policy tightening might be taking effect.

Annual inflation eased to 6.7% in August, below the expected 7.0%, primarily due to the slowdown in food inflation. PPI fell by 0.4% in August, compared to market expectations of a 0.6% decline.

The unemployment rate increased to 4.3% in July, slightly above expectations, indicating that the labour market may be cooling off after months of unprecedented monetary policy tightening by the Bank of England.

Consumer confidence rose to -21 in September, above the expected -.27, amid growing optimism about the economy and easing pressures on household spending. Retail sales rose 0.4% in August, just below the market forecast of a 0.5% increase. Annual sales fell by 1.4%, more than the expected 1.2%.

The composite PMI index fell to 46.8 in September, driven by the continued contraction in manufacturing and a steep decline in the services sector.

China

The unemployment rate dropped to 5.2% in August, matching June’s 16 month low of 5.2%.

Annual inflation came in at 0.1% in August, below market expectations of 0.2%, with core inflation increasing 0.8%. Annual Retail sales grew 4.6% in August, exceeding market estimates of 3.0%.

Composite PMI fell to 50.9 in September, as new orders rose at a softer pace with manufacturers and service providers recording only marginal increases in sales.

This suggests the downturn in growth may be stabilising, but real estate remains a weak spot in the economy with property investment falling 8.8% in 2023.

Japan

The Bank of Japan maintained its key short-term interest rate at -0.1% and that of 10-year bond yields at around 0% in its September meeting by unanimous vote.

The annual inflation rate fell marginally in August to 3.2% just below the market forecast of 3.3%.

The unemployment rate was unchanged at 2.7% in August, above the market prediction of 2.6%.

The consumer confidence index dropped to 35.2 in September, with sentiment dropping across all components. Retail sales rose 0.1% in August, with the annual rate rising 7.0%, above the forecast 6.6%.

The composite PMI came in at 52.1 in September as services activity grew the least in eight months, while factory output fell at the fastest pace for three months.

Currencies

The Australian dollar (AUD) appreciated over the month of September, closing 0.8% higher in trade weighted terms to 61.1, strengthening against the Pound Sterling (GBP), Euro (EUR) and the Japanese Yen (JPY) whilst depreciating against the US Dollar (USD).

Volatility continued throughout the month, primarily influenced by relative US strength driven by US Employment data, shifting US bond yields and messaging from the Fed’s September meeting. Additionally, the AUD was influenced by economic indicators from China such as a slump in Caixin China Services PMI.

Relative to the AUD, the USD led the pack in September, appreciating by 0.5%. Conversely, the GBP was the laggard of the month, depreciating in relative terms by 3.2% against the AUD. Year-on-year, the AUD remains behind the GBP and EUR by -8% and -6.8%, respectively, whilst ahead of the USD and JPY by 0.6% and 3.7%, respectively.