Monthly Market Review – November 2022

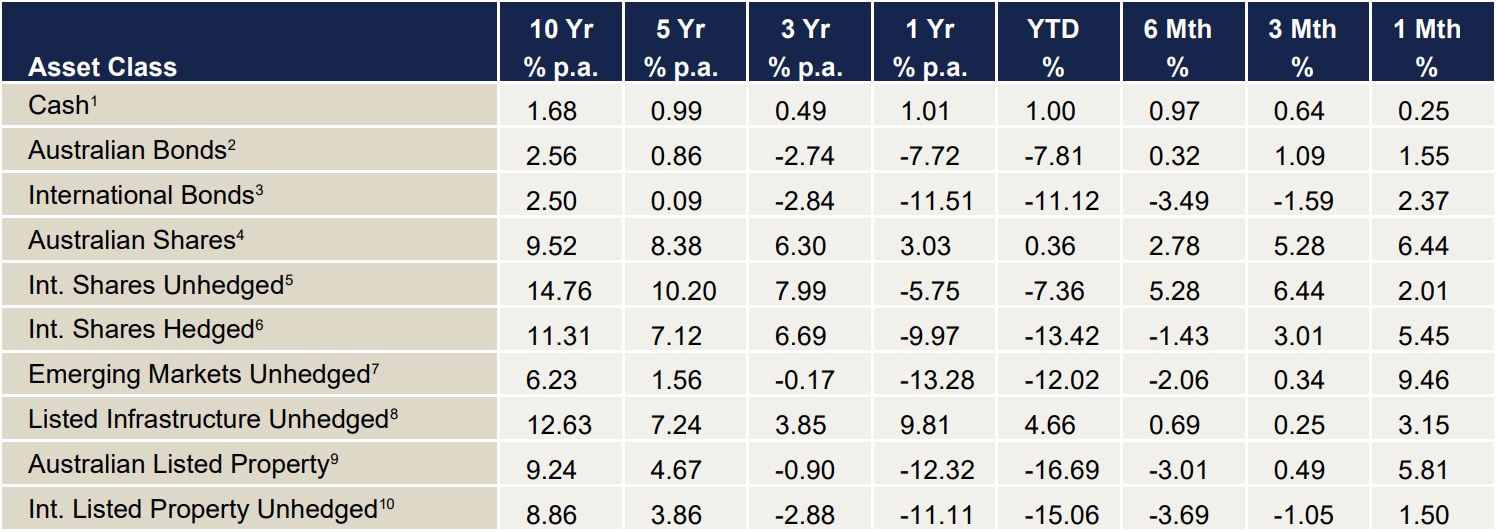

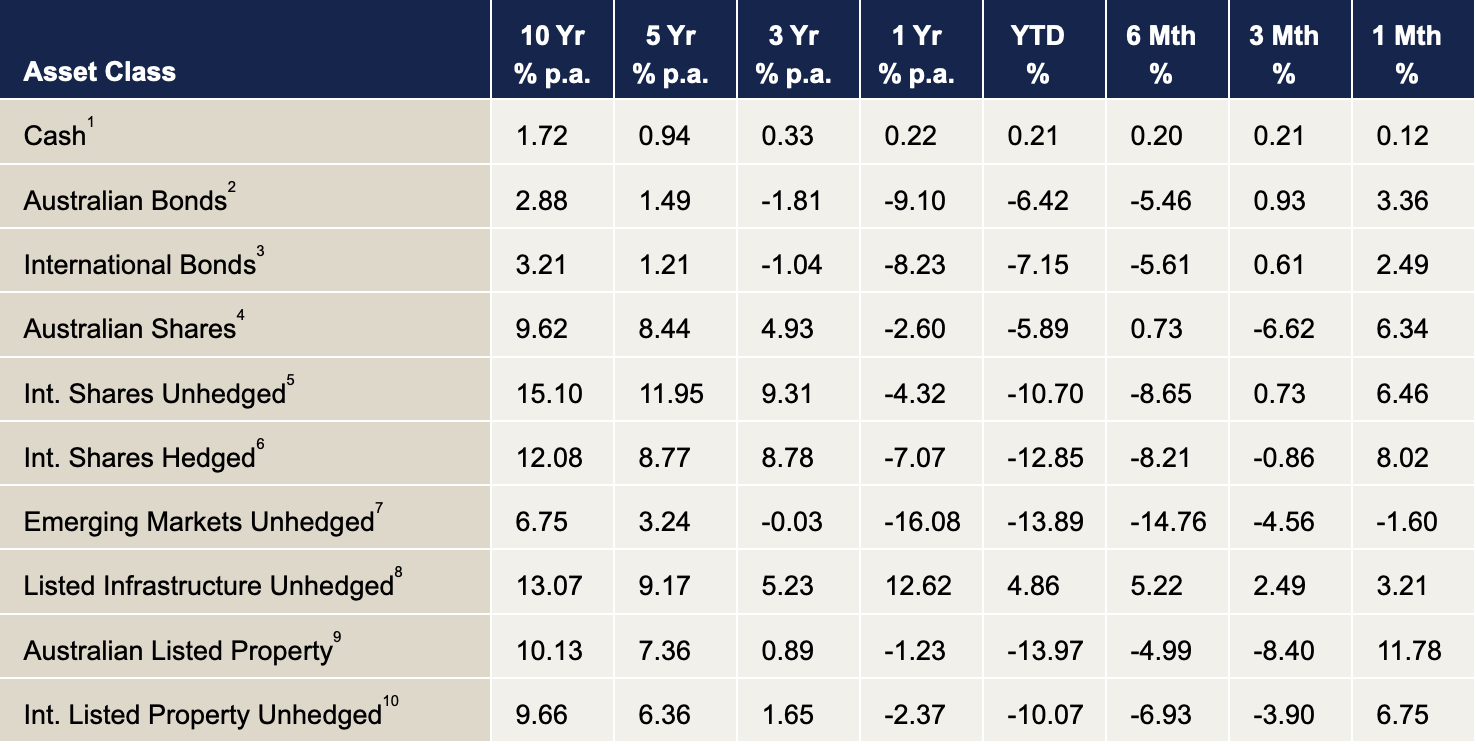

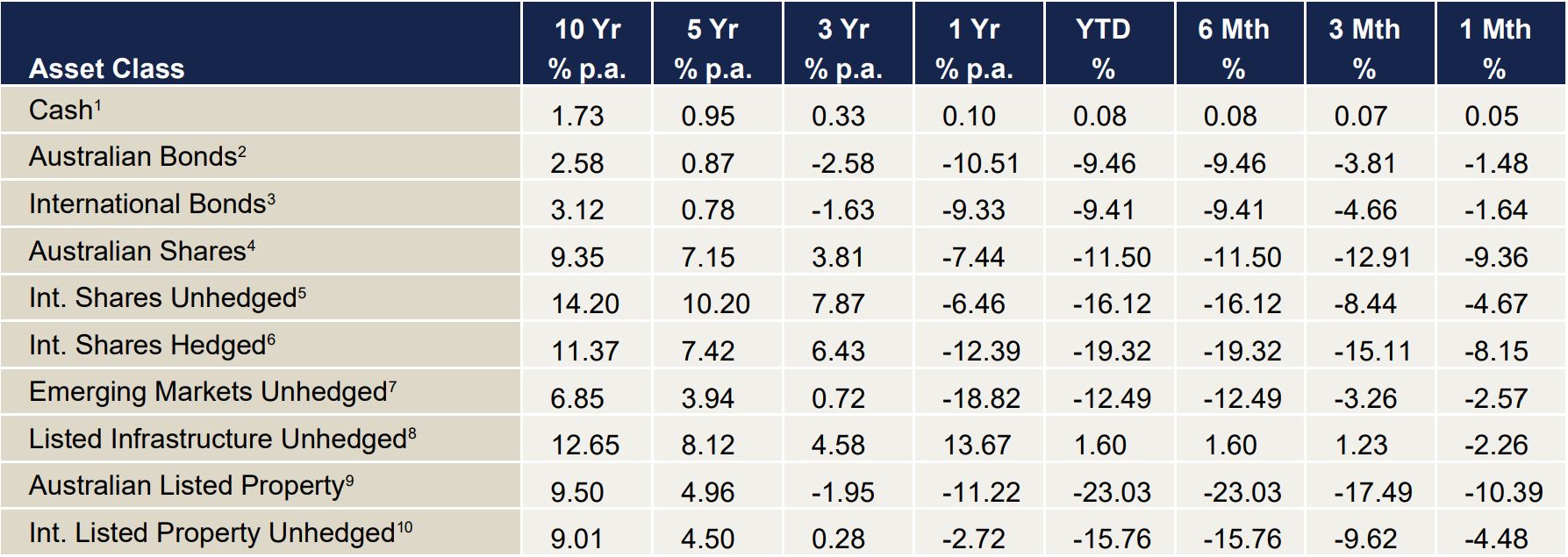

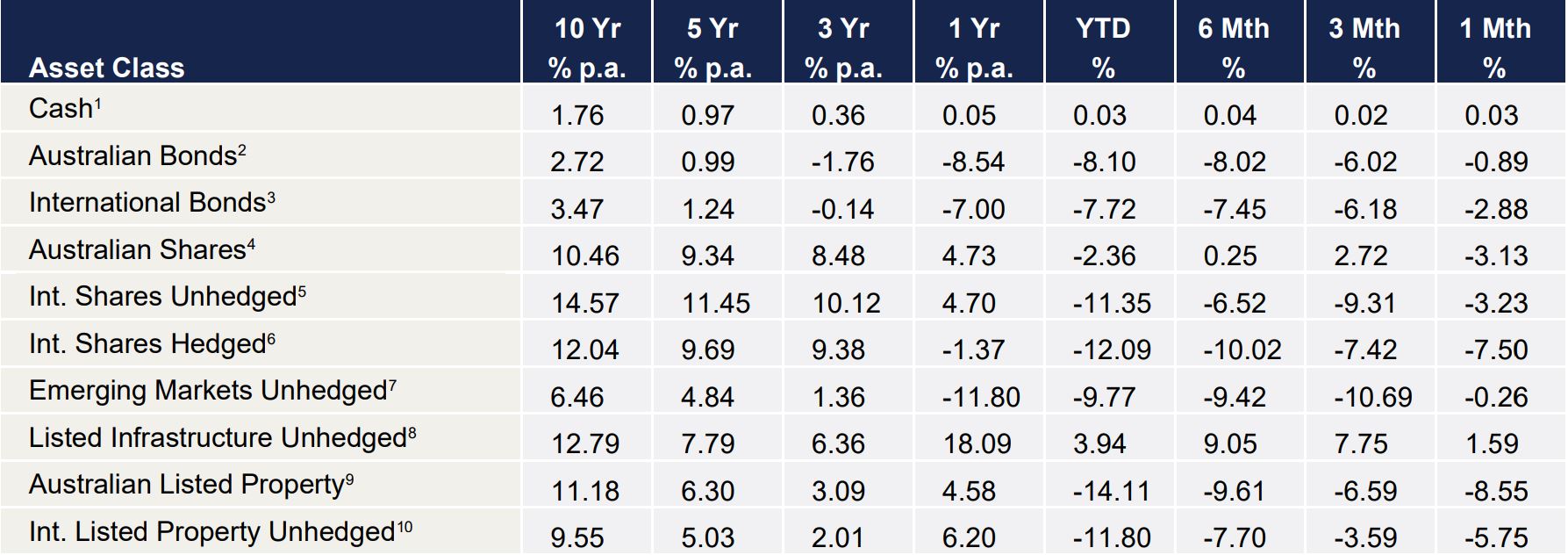

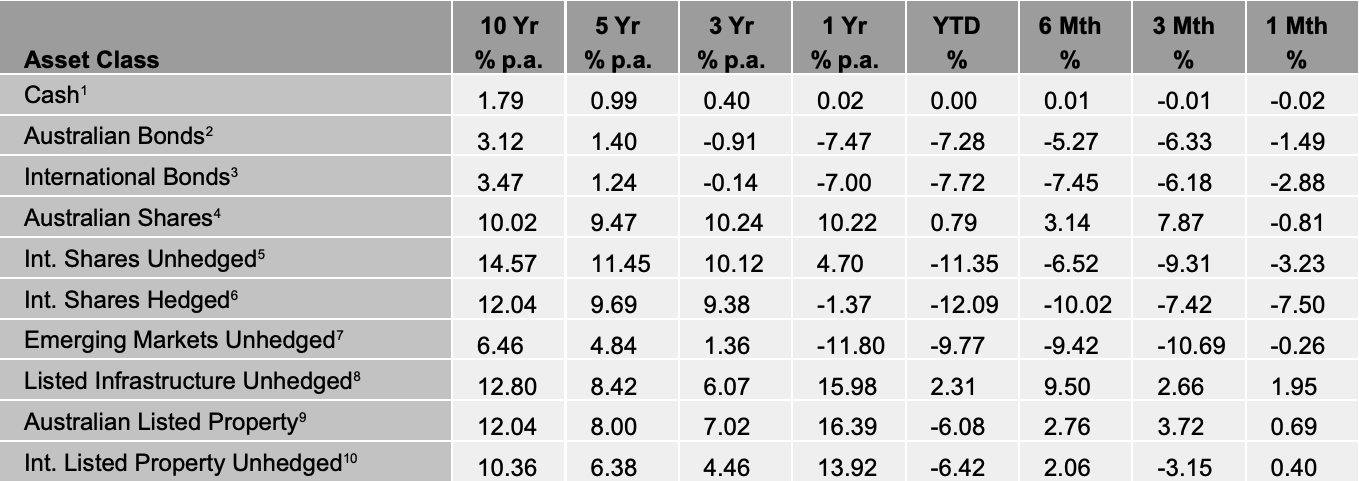

VIEW PDFHow the different asset classes have fared: (As at 30 November 2022)

1 Bloomberg AusBond Bank 0+Y TR AUD, 2 Bloomberg AusBond Composite 0+Y TR AUD, 3 Bloomberg Barclays Global Aggregate TR Hdg AUD, 4 S&P/ASX All Ordinaries TR, 5 Vanguard International Shares Index, 6 Vanguard Intl Shares Index Hdg AUD TR, 7 Vanguard Emerging Markets Shares Index, 8 FTSE Developed Core Infrastructure 50/50 NR AUD, 9 S&P/ASX 300 AREIT TR, 10 FTSE EPRA/NAREIT Global REITs NR AUD

Source: Centrepoint Research Team, Morningstar Direct

International Equities

International shares have now had back-to-back months of positive returns following the gain of 5.45% in hedged shares and 2.01% gain in unhedged shares. Markets rallied due to a mild moderation in inflation within the United States (US). Inflation was 8.2% in September and has now fallen to 7.7% in October. Whilst the number remains elevated, markets are taking note of the change in direction. US inflation peaked at 9.1% in June and has fallen slightly each month. This naturally starts to put less pressure the central bank to keep interest rates elevated to fight inflation. Interest rates have been the biggest cause of pain for the markets this year and the reprieve from this has been positive for markets.

Australian Equities

Australian shares had a very strong month in November, inking a 6.44% gain. This was aided by hopes of a less aggressive US central bank but was also combined with rumours of a China reopening. China moving away from the Zero-Covid policy would be highly constructive for global economic activity and therefore stronger materials exports for Australia. It is still up for debate whether China will truly reopen in the near future, however, there appears to be a gradual trend towards this as government restrictions have greatly impacted the Chinese economy causing civil unrest in many regions.

Domestic and International Fixed Income

Both international and domestic bonds had a positive month, returning 2.37% and 1.55% respectively. Once again this was driven primarily from the decrease in inflation within the US. Asset classes generally have been moving in quite a correlated nature based on inflation news. This means equities and bonds are having positive months at the same time. Historically, bonds and equities have been negatively correlated, meaning one will do well when the other does not. This is not the case when inflation is high. Once a moderation of inflation occurs, this relationship should return. The timing of this is difficult to know.

Australian Dollar

The Australian Dollar (AUD) rallied 4.8% during November. As mentioned in last month’s report, signs of inflation moderation would benefit the AUD. This is exactly what occurred over the month as the USD finally showed a reverse in trend with a near 5% drop in the US Dollar Index. The uncertainty within markets still remains high, so any apparent trend has the potential to change quickly. That being said, there is some reprieve in USD upwards pressure. A toning down in interest rate increase rhetoric by the US central bank would significantly move the USD lower over the coming months and send the AUD upwards. If China decides to entirely reopen much like the rest of the world, the AUD should significantly benefit from this too.

Disclaimer

The information provided in this communication has been issued by Centrepoint Alliance Ltd and Ventura Investment Management Limited (AFSL 253045).

The information provided is general advice only has not taken into account your financial circumstances, needs or objectives. This publication should be viewed as an additional resource, not as your sole source of information. Where you are considering the acquisition, or possible acquisition, of a particular financial product, you should obtain a Product Disclosure for the relevant product before you make any decision to invest. Past performance does not necessarily indicate a financial product’s future performance. It is imperative that you seek advice from a registered professional financial adviser before making any investment decisions.

Whilst all care has been taken in the preparation of this material, no warranty is given in respect of the information provided and accordingly neither Centrepoint Alliance Ltd nor its related entities, guarantee the data or content contained herein to be accurate, complete or timely nor will they have any liability for its use or distribution.

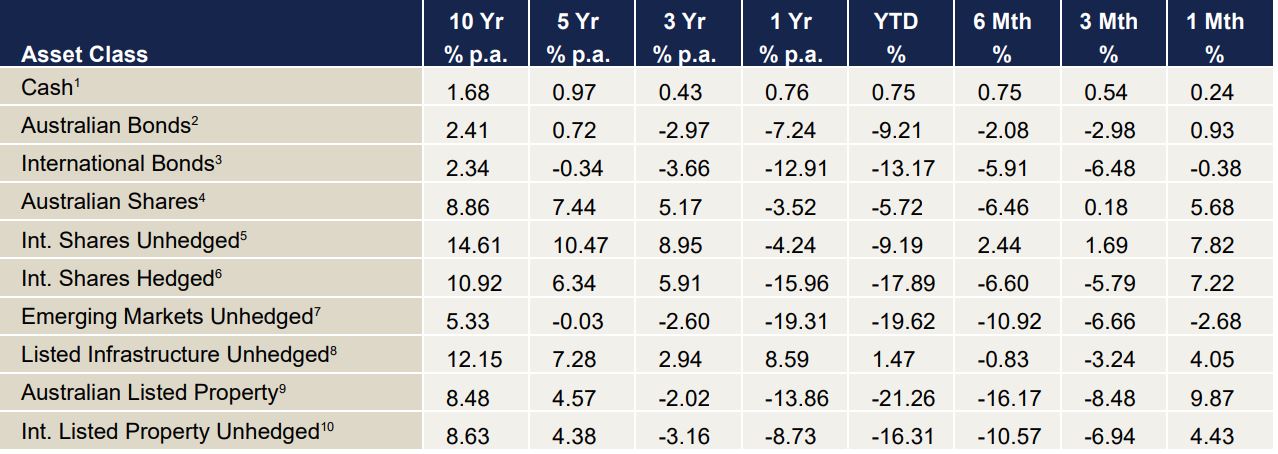

1 Bloomberg AusBond Bank 0+Y TR AUD, 2 Bloomberg AusBond Composite 0+Y TR AUD, 3 Bloomberg Barclays Global Aggregate TR Hdg AUD, 4 S&P/ASX All Ordinaries TR, 5 Vanguard International Shares Index, 6 Vanguard Intl Shares Index Hdg AUD TR, 7 Vanguard Emerging Markets Shares Index, 8 FTSE Developed Core Infrastructure 50/50 NR AUD, 9 S&P/ASX 300 AREIT TR, 10 FTSE EPRA/NAREIT Global REITs NR AUD

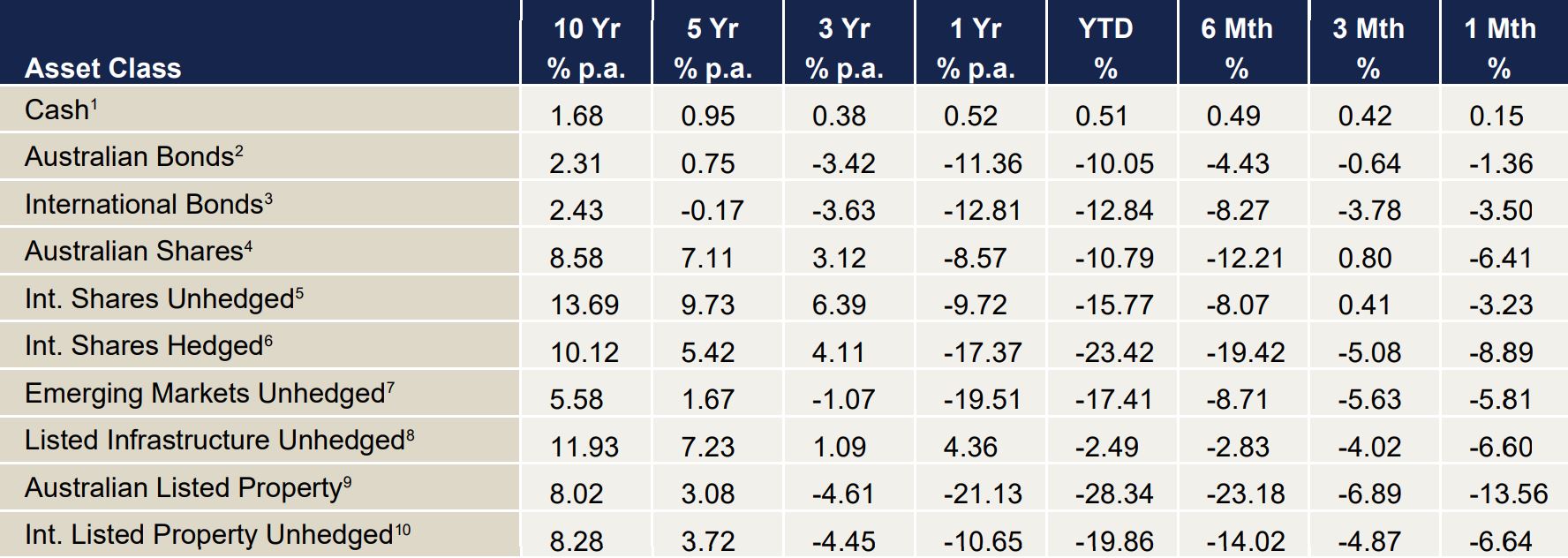

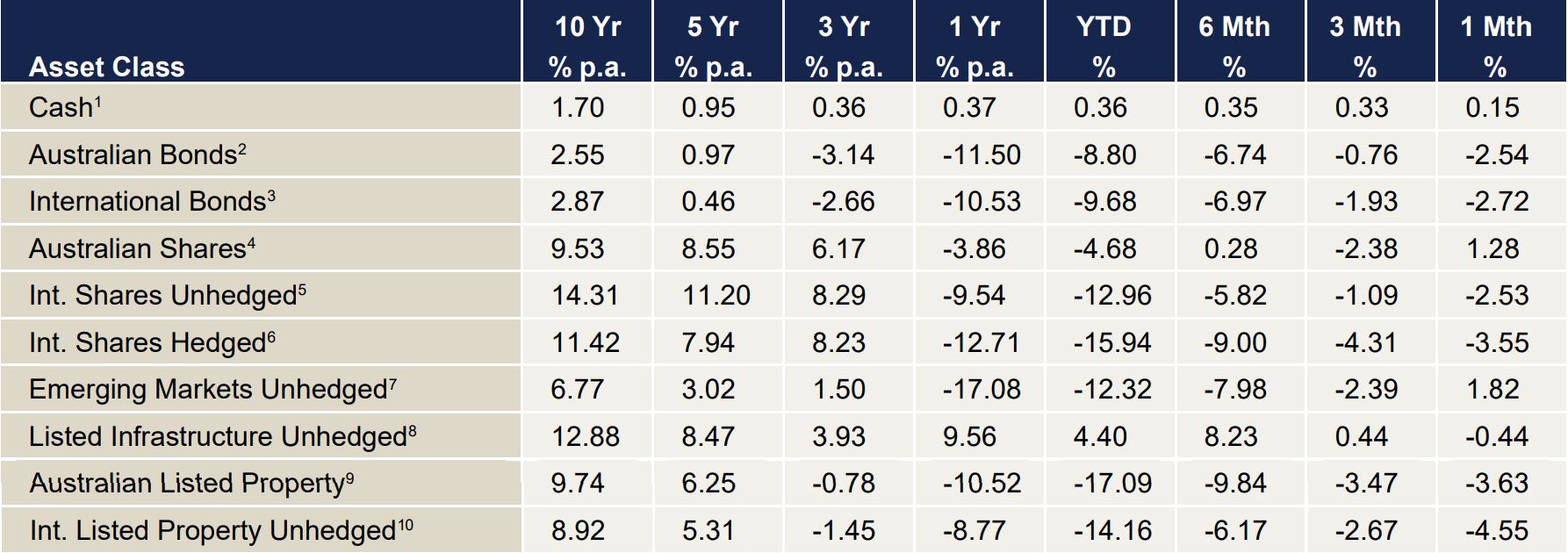

1 Bloomberg AusBond Bank 0+Y TR AUD, 2 Bloomberg AusBond Composite 0+Y TR AUD, 3 Bloomberg Barclays Global Aggregate TR Hdg AUD, 4 S&P/ASX All Ordinaries TR, 5 Vanguard International Shares Index, 6 Vanguard Intl Shares Index Hdg AUD TR, 7 Vanguard Emerging Markets Shares Index, 8 FTSE Developed Core Infrastructure 50/50 NR AUD, 9 S&P/ASX 300 AREIT TR, 10 FTSE EPRA/NAREIT Global REITs NR AUD