Investing in recovery In his third and possibly last Budget before the next federal election,…

Investing in recovery In his third and possibly last Budget before the next federal election,…

If you’ve recently split from your partner or are simply wondering what might happen if you do, you’ll need to keep your financial wits about you. A division of assets and debts, whether they’re held separately or together, may be on the cards.

Here are some of the things to be aware of when it comes to de facto splits and your finances.

A de facto relationship, according to Australian family law, is where two people of the same or opposite sex live together on a genuine domestic basis as a couple. You can’t be married to each other or related by family.

Not all de facto couples have to divide property of the relationship (that’s your assets and debts) when they break up. However, depending on your situation, this may be the case and can be formalised between the two of you without any court involvement.

If you can’t agree though, you can apply to a court for financial orders regarding the division of property and possibly superannuation, while spouse maintenance might also be payable in some circumstances.

This must be done within two years of you splitting from your former partner, otherwise, you’ll need special court approval to make an application.

The family law courts can order a division of any property you and your de facto own (regardless of whether you own it together or separately) if they’re satisfied of one of the following:

Property includes all assets and debts held in joint or separate names and may include things you acquired before or even after the relationship ends. This could include things like:

Under superannuation splitting laws, if you separate, it’s possible you’ll get some of your ex-partner’s super or that they’ll get some of yours.

However, because super is held in a trust and differs from other types of property, there are rules around when these assets can be accessed.

What this means is, splitting super doesn’t necessarily convert it into cash as it’s still subject to certain rules, which may mean that you mightn’t be able to access the money for a long time.

Seek financial advice to help you understand the long-term outcomes of different settlement options. Please reach out to the Sherlock Wealth team to discuss your unique situation here

Source: AMP

How much do you need to save to make sure you have enough to last throughout retirement? It very much depends on what your living costs will be after leaving work. Find out more about how to budget for the retirement income you’ll need for the lifestyle you’re planning for.

When you plan to retire will often be determined by whether you can afford to stop working and still have enough income to maintain your lifestyle. Figures from the Australian Bureau of Statistics[1] show the majority of men (36%) and women (22%) chose to retire at the time when they became eligible to draw on their superannuation and/or the age pension. And their average age at retirement was 63.5 years.

If you’re planning to delay retirement until your super balance reaches an amount you can comfortably live on, just how do you determine what that target should be? There are a number of factors that will affect how far your money will go, including your life expectancy, how your money is invested and other choices you make for managing your income. But one of the most important steps to planning for a secure financial future in retirement is to be realistic about your living costs.

How your living costs might change

As you stop working and have more time to yourself, your routine will change and you might save on some costs as a result. Spending on transport could fall as you no longer have to commute. If buying lunch and takeaway coffees have been a daily habit while working, you could also make significant savings by leaving these out of your retirement routine. Other living expenses, such as buying groceries and clothes and paying household bills are likely to be much the same before and after retirement.

Thinking about how you’ll spend time in retirement and where you’re planning to live will also give you clues about how your spending might go up or down. If a few trips overseas are on the cards, you’ll need to allow for these occasional costs in your overall budget. But if you’re planning to limit travel to domestic holidays only, then you won’t need to allow for these expenses in your financial plan.

Start with a ballpark estimate

How much travel you plan to be doing is just one of the many daily and one-off costs taken into account in the Retirement Standard estimates for annual expenses. Updated every quarter by the Association of Superannuation Funds of Australia (ASFA), these figures can give you a rough idea of what you can expect to be spending day-to-day in retirement.

There are two estimates available, a higher one for a comfortable lifestyle and a lower amount for a modest lifestyle. As at December 2018, the amount you’d spend as a single person aged around 65 years enjoying a comfortable lifestyle is $43,317 and for a modest lifestyle, the annual budget is $27,648. The estimate for couples is $60,977 and $39,775 for comfortable and modest lifestyles respectively.

To give you an idea of how differences between a modest and comfortable budget might impact on your retirement plans, the annual travel budget is a good place to start. A couple living modestly can expect to spend approximately $2,500, with no allowance for overseas trips. On a comfortable budget, a couple can splash out more than $5,000 each year on travel, with roughly a third going towards international travel.

The cost of lifestyle changes

Although it’s wise to build a budget based on what you expect to be doing in early retirement, your overall plan should also take into account the potential for lifestyle changes as you age. Travelling for longer periods, dining out and entertainment and taking part in sports and hobbies could taper off as you grow older. Health and aged care costs, on the other hand, could make up a larger share of your budget in the later years of retirement.

A plan to see you through retirement

Your expenses are just one side of the whole budget planning process. Taking a good look at all your retirement income options is just as important to figure out how much you’ll need and when you’ll be ready to take that step. From the age pension to the equity in your home to retirement income products such as annuities and account-based pensions, there are all sorts of ways to support yourself financially towards having the lifestyle you want.

The Sherlock Wealth Team can support you in exploring these opportunities to manage your income for your whole retirement so you can make better choices for a secure financial future. Reach out to the Sherlock Wealth team to discuss your unique situation here

Source: Money and Life

(Financial Planning Association of Australia)

Aussies may have a natural reserve when it comes to talking money. But as parents, teaching our kids to be financially aware and responsible takes more than a few quick lessons about money and the opportunities and pitfalls it can create.

Teaching opportunities will come and go as our children grow. If you’re a relaxed sort of money parent, then maybe you’re happy to freestyle and just take these chances as they come. But if you’re keen to create teaching moments by design, it can help to know what other people do and when are the best windows in your child’s development to introduce new financial concepts.

In 2018, 1000 Australian parents were surveyed about how they teach their kids about money for the Share the Dream report. Results show that half of parents are talking to their kids regularly about money and almost three-quarters of kids (72%) are getting pocket money, an important tool for teaching kids about saving and spending money. The age group most likely to be getting pocket money are 9-13-year-olds (80%) and if you’re aged 4-8 years you’re less likely to receive any (65%).

But according to a Cambridge University research study from 2013, parents could be missing a trick if they’re waiting until kids turn nine to start pocket money. Their findings suggest that by the age of seven, kids have already acquired the mindsets that will direct their money habits in adulthood. Not only that, but they’re also capable of grasping the fundamentals of how money works at this age. They understand that money can be exchanged for goods and that you need to earn it first.

Dr David Whitebread, the co-author of the study, encourages parents and educators to get on the front foot when it comes to helping kids learn good money habits early on. “The ‘habits of mind’ which influence the ways children approach complex problems and decisions, including financial ones, are largely determined in the first few years of life,” says Dr Whitebread. “Early experiences provided by parents, caregivers and teachers which support children in learning how to plan ahead, in being reflective in their thinking and in being able to regulate their emotions can make a huge difference in promoting beneficial financial behaviour.”

As well as starting money lessons early, stats from the Share the Dream report also suggest that money talk from parents needs to be covering more ground. Many parents are definitely covering off the basics, with the majority of parents (52%) having talked with kids about spending and saving in the last six months. On the other hand, talking about cashless payments with kids is far less common. Only 19% of parents have spoken about online transactions in the same period, and the numbers discussing in-app purchases (13%) and Afterpay (5%) are smaller still.

The study also shows that there may be advantages to being more forthcoming about ‘invisible’ money transactions with our kids. Across all age groups 38% of parents are reporting that their kids have a preference for online purchases. For the teenagers in the 14-18 group, this figure rises to nearly half (47%). If kids are to be prepared for their online shopping experiences, it makes sense to be having these discussions as they begin to transact online.

Talking money with our kids can make us feel uncomfortable and this is a trend that was also revealed in the Share the Dream survey. 68% of parents sometimes feel reluctant to talk about money with their children and in the majority of cases (32%), it’s because they don’t want their kids to worry about it. And 19% of parents say they don’t feel good enough about their own financial situation to discuss it as a family.

While financial stresses can be very real to you, there may be a way for you to help your kids learn from your own ups and downs with money without causing them concern. In fact, the ‘Engager’ parent profile identified in our survey shows that having more family discussions about money can lead to their kids being more curious, confident and financially literate. Engagers are least reluctant to talk to their kids about money and it seems their honest approach is leading to more positive habits among their children, 56% of whom are likely to have a job, compared with the survey average of 44%.

Source: Money and Life.

Recent studies show that more than two in five Australians lack confidence when it comes to financial decision making.

The Federal Government believes this is largely due to a lack of financial literacy within the community, which is why it has developed the National Financial Literacy strategy. This initiative aims to motivate Australians of all ages, genders and socioeconomic backgrounds to engage more with their finances. In turn, this will help people make informed financial decisions that will improve their economic wellbeing.

As social norms and family structures have changed, financial decision-making is no longer the sole domain of the male breadwinner – these days it’s just as important for women to take charge. Yet women experience higher levels of stress when it comes to managing money, with more than a third saying they find it overwhelming.

That’s why it’s vital for women to build their financial literacy. Becoming more financially savvy can change a woman’s life, by empowering her to be self-sufficient and make confident decisions that will improve her financial situation. Currently, only 10% of Australian women retire with enough savings to fund a comfortable lifestyle – so by arming women with strategies to help close the ‘super gap’ at each life stage, they may become less reliant on social services in retirement.

The financial decisions women make throughout their lives can impact their financial position in later years. With this in mind, here are some things you can do to take control at each stage of your life journey.

Generally speaking, the gender pay gap puts women on the back foot as soon as they enter the workforce. Although there may be greater equality between the sexes than ever before, women’s average salaries are still 17.3% lower than those of men doing the same job.

This highlights how important it is for women to be able to budget if they want to build their savings and get ahead.

Women are still more likely than men to take time out of the workforce to raise kids, which means they receive less in employer super contributions during their careers. This leads to a significant super gap – men have an average super balance of $292,500 when they retire compared to $138,150 for women.

That’s why you need to prepare carefully for your career breaks, and top up your super either before or after to make up any shortfalls. The Government’s Parental Leave Calculator and Career Break Super Calculator make it easier to plan your finances around having a family. Visit https://www.moneysmart.gov.au/tools-and-resources to access these calculators.

If you’re like most women, the largest debt you’ll ever have to pay off is your home loan. Before taking the plunge into homeownership, a Mortgage Calculator can show you how much you can afford to borrow, so you can work out a repayment plan that fits your budget. And if you’re prone to splurging on your credit card, a Credit Card Calculator could help stop your debts from spiralling out of control. Visit https://www.moneysmart.gov.au/tools-and-resources to access these calculators.

With lower confidence levels and a smaller appetite for risk in their investments, women are less likely than men to choose high-growth investments like shares. This also means they miss out on potentially higher returns. But as women generally retire earlier and live longer than men, they can expect to spend more time in retirement – which makes it even more important for them to have enough money to last the distance. As the first step, make sure your investment mix matches your life stage. That way your super and other investments will have the best chance of growing over time.

Because women face so many distinct challenges, they need customised solutions – which is where a licensed financial adviser comes in. If there’s ever an aspect of your finances that you’re unclear about, reach out to the Sherlock Wealth team to discuss your unique situation here. We can explain it in a way that makes sense to you, so you can make wiser financial decisions.

Source: AMP News & Insights.

A huge sum of wealth is acquired by beneficiaries every single year – whether in the form of inheritance after death, or via gift transfers. However, over the last few years, headlines about ‘the inheritance economy’ and ‘the big intergenerational wealth shift’ have appeared just about everywhere in developed economies.

Researchers across the globe reached the same conclusion: we are on the brink of a vast shift in assets, unlike any that we have seen before.1 Globally, worldwide demographic trends are putting in place the foundations for the largest intergenerational wealth transfer in history over the next 50 years. In Australia alone, it is expected that we will see around $3.5 trillion change hands over the next 20 years, growing at 7% per year.2

Coined as ‘the Great Wealth Transfer’ of the 21st century (GWT), it is expected to bring about a total overhaul to the way that current financial advice practices work. Is your practice ready?

There are a number of contributory factors that account for this large shift in money. The two main reasons are the increased net worth and changes in life expectancies.

In 2017, Australian household’s net wealth stood at a record $8.1 trillion.3

Growth in household net worth has historically been largely tied to property values, income and ability to save this income.

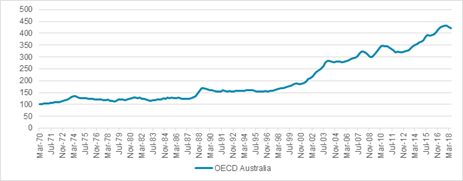

A huge proportion of this increase has been due to the rise in property prices we’ve experienced in the last 25 years. This works out at an average annual real growth rate of 4.1% p.a. above general inflation and earnings growth as shown in Figure 1.4 The beneficiaries? Baby boomers, who were able to get on the property ladder in the 1980s, and stay on it ever since.5 Indeed, the Household, Income and Labour Dynamics in Australia (HILDA) survey shows that the home is still the biggest asset, with superannuation and other property following closely behind.6 Thanks to capital growth, property can be expected to account for around 70% of the wealth transferred over the coming years. 7

Source: OECD

Baby boomer wealth profiles are characterised by high levels of homeownership and the rewards of the periods of economic prosperity that have occurred throughout their adult lives.

In addition to homeownership, the introduction of the Superannuation Guarantee system in 1993 has seen substantial growth in levels of superannuation holdings, which in turn has increased the amount of potentially heritable assets.8

Booming equity markets are another contributory factor to Australians’ net worth. Capegemini’s 2018 World Wealth report indicates that a growing number of individuals have hugely increased their asset bank thanks to the equity rally we have experienced over the last few years.9

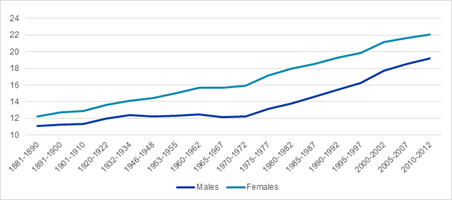

Like their net worth, the life expectancy of baby boomers has increased. Thanks to a greater awareness of healthy living practices, medical advancements and improved assisted-living facilities, our elderly are living longer. Life expectancy in Australia at age 65 has significantly grown, especially since the 1970s – from 12.2 to 19.2 years for males and from 15.9 to 22.1 years for females as shown in Figure 2.

Source: Australian Government Actuary, Australian Life Tables

Living longer means that our elderly community are holding onto their assets for longer. The population aged 75 years or more is expected to rise by 4 million between 2012 and 2060, increasing from about 6.4% to 14.4% of the population.10

However, projections suggest that we will see a rising number of deaths over the next few decades. From 147,200 in 2011-12, the Australian Bureau of Statistics (ABS) expects the annual number of deaths in Australia to more than double to 352,100 in 2061 and more than triple to 545,400 in 2101.11 A significant proportion of these people is likely to transfer wealth upon death, so it is likely that we will see inheritance shift en masse.

1 Cutler, N.E., D, S. J. 1996 An inheritance boom for boomers? Looking beyond the headlines. Journal of Financial Service Professionals, 50(5), 4.

2 McCrindle (2016). Wealth Transfer Report, A Report for No More Practice, September. With an estimated 7.5 million children, if 70% of wealth is transferred then it is estimated approximately $326,000 on average will be passed on to each child. If this is spent, it is likely to be eroded in two years, but if managed well, it could help Gen X and Y fund their own retirements.

3 https://www.roymorgan.com/findings/7404-australian-households-net-wealth-now-over-eight-trillion-dollars-and-growing-201711092241

4 OECD Database (September 1993- June 2018)

5 Norman Morris, Roy Morgan Research November 2017

6 Johnson, D (2017) Australia’s hidden treasure: The immense potential of baby boomer housing equity in averting a retirement cashflow crisis. PhD thesis. Griffith University

7 Template, J., McDonald, P.Rice, J. Net assets available at age of death in Australia. Population Review Volume 56, Number 2, 2017., Sociology Demography Press.

8 The 2015 Intergenerational Report; Australia in 2055 predicted that superannuation assets alone could rise to $9 trillion by 2040 (Treasury, 2015).

9 CapeGemini, ‘World Wealth Report 2018’, p.16.

10 Productivity Commission, 2013. An Ageing Australia: Preparing for the Future,

11 ABS 3222.0 – Population Projections, Australia, 2012 (base) to 2101 released Nov 2013

You might like to start with a pre-paid card or a debit card, so there’s a limit on what they can spend. Set the rules on what it can be used for and how much they can spend. If they manage the process well, and if you’re confident that they’re responsible enough, you could give them a credit card (which would be a supplementary card connected to your own, as children under 18 cannot have their own card).

Before you give your teen a credit card, take the time to have a conversation about credit card fees, interest rates, and how spending irresponsibly can give you a bad credit rating, which is bad news for their future. Be clear that they will be responsible for all expenditure on the card – if they can’t afford it with cash, they shouldn’t put it on the credit card.

Giving a teenager a credit card may seem risky or even irresponsible, but it can be a great teaching tool if the right conversations, rules and limits are put in place.

Before you give your teen a card, be sure to speak to them about how it works, how to be responsible with it and how to avoid financial trouble, including:

The growing popularity of ‘buy now, pay later’ services such as Afterpay, Openpay and zipPay means it pays to help your teen understand how they work, and what the risks are.

These services allow shoppers to buy a product, take it home and pay for it in instalments via an online ‘buy now, pay later’ account, which deducts your preferred debit or credit card. Added to that, while the buy now, pay later provider might not charge interest on your purchase, you may still have to pay interest to your credit card provider if you don’t pay the full amount owing on your credit card by the due date.

While knowing the ins and outs of debt is important, one of the most powerful ways to help your kids develop healthy money habits is to lead by example. Our ideas about money are formed in our childhood, so if your kids see you living with healthy financial habits, they’re more likely to form those habits themselves.

Source: AMP

For the second time in 2022, the government of the day has delivered a Federal Budget. Last night’s Budget was the first delivered by the new Labor government that was elected in May 2022.

Given the present state of the economy post-COVID, a worsening economic position due to inflation and increased global instability, rising interest rates and cost of living pressures, the Budget was conservative by nature. There were no big surprises… Download our full analysis!

Disclosure: This information is intended to provide general information only and has been prepared without considering any particular person’s objectives, financial situation and needs (‘your circumstances’). Before acting on such information, you should consider the appropriateness of the information regarding your circumstances.